Asset allocation in a time of uncertainty

There is great uncertainty about the course of markets this year. In this note, we look at defensive assets, IAU and SHV, to complement our KISS portfolio IOZ+IOO.

In this note, we follow up on our past ETF study involving core equity allocations to Australian and Global equity. Previously, I promised to look at other assets. My two favored defensives are short-term US Treasury Bills, and gold. I explain why.

Sometimes, the obvious thing to do is the right thing to do.

Donald J. Trump is the new President of the United States, and he promises to Make America Great Again (MAGA). We are not sure what that means to voters but have clear views on what counts as greatness in the mind of Donald Trump.

Donald J. Trump is happiest when the stock market is booming.

Achieving such conditions is not that hard in the short run.

Excess dollar liquidity will lift all boats in a financial market.

Jawboning an influx of foreign investment dollars, lower interest rates, and a rosy picture of the national outlook is a great way to sell stocks and bonds.

Donald Trump is likely to do exactly that - drive looser financial conditions.

His nominated Secretary of Treasury, Scott Bessent, came out at the confirmation hearing with this framing of the importance of Trump’s promised tax cuts:

"This is the single most important economic issue of the day. This is pass-fail. If we do not fix these tax cuts, if we do not renew and extend, then we will be facing an economic calamity, and as always, with financial instability that falls on the middle and working class." - Scott Bessent, Senate Finance Committee hearing, 16-Jan-2025

I am not sure about the framing of the benefits, as falling to the working class, but the continuation of the former Trump tax cuts, will be marked into stock prices.

The positive pitch will be enough to carry markets for some time. The proof is in the pudding, but Americans are patriotic by nature. These markets will rise.

Of course, it is quite possible for the wheels to fall off in so many ways.

There could be a new war in the Middle East and higher oil prices.

Trump tariffs could backfire on the USA in the form of higher domestic inflation.

China may get fed up with Trump and the economic war may worsen.

Unless and until these things happen, we won’t know the ultimate course of events, but we must be mindful of the risks and attempt to make our own lives simple.

You can bet that the Trump 2.0 Administration is rooting for higher asset prices.

There are billionaires involved, at all levels, and we know what they want.

Billionaires want higher asset prices.

On this occasion, the billionaires that Donald Trump has recruited, swear blind that they are working for working Americans, and we know what those folks want.

Working Americans want higher wages.

Something tells me that, of these two objectives, the first one is more likely to happen before the second one, if it happens at all. The first helps profits, the second less so.

This may seem a little hard-bitten, and maybe even cynical, but the uncertainty of the investment outcomes is likely to show up long after the foundations are poured.

Right now, we think there will be the usual celebrations when ribbons are cut.

There are too many imponderables to know how Trump 2.0 ends.

The beginning looks easy - up and to the right

However, we do know that it will start with fireworks, and maybe upwards of over 200 measures in a series of portmanteau Executive Orders (EO). That is so many that the market is not likely to read all of them. Markets will go up, knowing that something will go bang somewhere, but probably a long way from Wall Street.

The beginning is an up move, of that we are pretty confident.

The middle requires some thought, particularly the timing. Is it the chronological middle of the presidency? Is it the mid-Term elections? We don’t think so.

What we know, of all good bedtime stories, is that the middle bit is a set up for the end. We cannot know the end, but we can follow one important plot twist. This is most obviously the course of inflation and interest rates. These matter.

We are less worried about the economy as that can be juiced by liquidity.

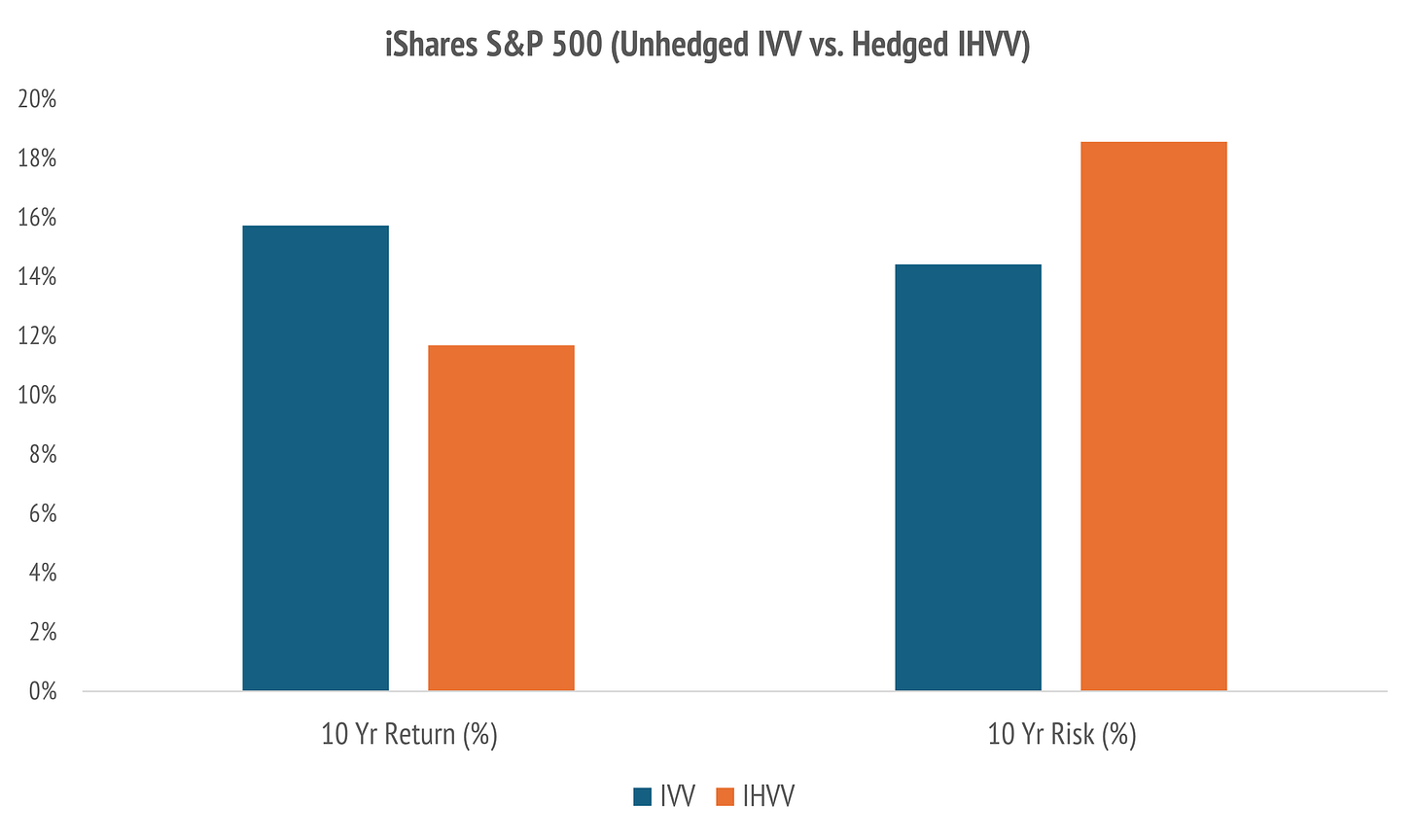

In our piece, Going Global with ETF product, I compared a shortlist of ASX Exchange Traded Funds (ETF) that could provide exposure to US, Australian, and Global stocks. For specifically US stocks, it is hard to go past the S&P 500 ETF IVV.

The beginning of the Trump presidency is likely dominated by the macro effects of a firmer USD, foreign inflows chasing US assets, and tax cuts. This lifts all boats.

From a stock-pickers perspective, the time to get cute and zero in on particular stocks and industries likely comes later, when the policy detail is clearer. There will be plenty of brokers doing this from the get-go, but we think the macro effect is dominant.

The middle comes when and in what form?

The Big Bad Wolf of inflation is only a problem once it eats you. The run from an inflation can be fun, for a while, as higher nominal selling prices help nominal corporate profits. That is as long as costs, such as rents, wages, gasoline and commodity inputs remain constrained. Inflation feels good, early on.

The middle part of this story is very uncertain.

Poking around with punitive tariffs on imports, and the pursuit of pro-business investment policies, is likely to generate an immediate surge of activity.

The Morning in America presidential campaign of Ronald Reagan is the inspiration of the incoming Trump Team. Who can fault them for wanting a good outcome?

Personally, I find such sentiments a little cloying and schmalzy. However, I am not a billionaire who is used to such showmanship, nor am I a patriotic American.

What works for markets is what works for the people in the market.

Americans have strong ownership of their economy and their stock market.

Not only will the beginning be positive, but most of the middle also.

I know that seems hard to believe, with the US Debt pushing 120% of GDP and interest rates on the 10 Year bond in the high 4’s and nudging 5%.

This would be enough to make most leaders shy of talking up their book.

The middle part is likely up also, but the talk must start producing results.

This question, the question of what actually happens, is the key uncertainty.

This period is likely to involve much speculation on the future course of inflation, and also the geopolitical tensions created by Trump’s tariff policies and sanctions.

Gold is a great asset when the risk is what will happen internationally.

For this purpose, we prefer adding some exposure to a gold ETF. In the USA, you can buy the iShares Gold ETF IAU. On the ASX you can buy iShares GLDN.

We can be reasonably confident that Trump will go through with his tariffs. This will make life in many other parts of the world quite difficult. Due to the pro-investment policies of Trump, and bullish domestic sentiment, a boom is likely.

When the USA encourages investment, the U.S. dollar tends to appreciate.

During the early phase of dollar appreciation, the effects on business and consumers are generally positive. Paradoxically, the domestic focused businesses, those who mainly sell onshore to Americans, do a lot better. The economy is booming.

This grows bank deposits and supplies the firepower for banks to fund corporate expansion, to build new factories, shopping malls, or housing.

The early domestic effects of such expansion are very positive.

The situation for importers, who face absorbing higher import prices, or passing those through to consumers, are likely to delay the latter and beat up their suppliers, who reside offshore, and failing that to absorb the margin pressure in the short run.

Inflationary pressures are delayed as companies shift the burden to suppliers.

This can be very beneficial to a large economy like the USA, which is not heavily trade dependent, but which can secure good terms of business from suppliers.

Presently, the largest exporters to the USA are Mexico, Canada and China.

The corollary to Morning in America is pretty clear:

Take Berocca on the Morning After in Mexico, Canada, and China.

There will be global pain due to Trump’s tariffs.

You can see now the possible shape of the ending.

Perhaps we all live happily ever after:

The billionaires get their stock options cashed.

The American workers bank higher wages in better houses.

Foreigners make new career choices that please them.

This is possible.

There are very many other possibilities:

Some involve American workers with pitchforks.

Some involve Foreign former billionaires with pitchforks.

There is a scale of outcomes between Angel Cake and Pitchforks.

The choice is between better outcomes for the USA, that others can tolerate, or something that is a bit more Gothic.

Perhaps it is Mexican Gothic, or Chinese Gothic?

Canadian Gothic seems unlikely, but I did see Twin Peaks, and so it worries me.

In between Fargo, and Twin Peaks, I don’t want to know about Canadian Gothic.

There will be bears. There will be lumberjacks. There will be guns, axes, and saws.

Canadians are nice people, but I don’t want to press the issue too much.

Our trouble is the bit which takes us from the middle to the end.

This is all simplistic, which is what I promised you.

The doubts I have are not how it all starts, but how it all ends.

If it starts well, as I think it will, you should stay in stocks. If it ends well, and you start in stocks, it will end well for you if you stay in stocks. The trouble is the end.

Gold is certainly good in the middle, when global geopolitical risk is key, along with speculation on inflation, but you may want some cash towards the late cycle.

Let us talk about the End

Things ending well, that is easy, it is stocks, and US ones will do well.

The End could be good, in the sense that it looked just like the beginning.

However, for the Jim Morrison fans who are still alive, that was a long song, and it did not get any more positive with the refrain “This is the end. My only friend, the end.”

Social media is full of market crashes, and bitter ends, and they happen daily.

Knowing what those folks are focused on is helpful.

It is especially helpful when you find well-reasoned investment cases that are sober in their mix of opportunity. Some assets for the good times, some for the bad times.

I want to know where to go when things get ugly.

This is the sort of end, which is properly a setup for a new beginning.

This is a bear market, from which the new bull market will emerge.

The key is to preserve purchasing power and there are two risks to consider:

Cash is always tied to a currency

Inflation eats purchasing power and differs by economy

Certainly, it is good to choose defensive assets that protect real purchasing power, but it is also good to generate income. The two such assets that spring to mind now are gold, which is the currency of no government, and US Treasury Bills.

In other scenarios, one may be less fixated on performance in U.S. dollars.

However, the Trump policies are likely to encourage a strong dollar, that partially offsets the rise in domestic prices from import tariffs. The presently high rates on short-term money in the USA are attracting safe haven investments.

During the Global Financial Crisis (GFC), investors lost money betting on higher rates of interest in short-term money market funds. These involved credit risk. There was limited transparency about what those funds bought, and so many piled into Credit Derivative Obligations (CDO), which was a form of financial insurance contract.

Investors were shocked when they lost money on such money market funds.

Avoid structured products offering higher rates of interest.

The purpose of a defensive asset is to protect purchasing power in a bust.

The issues in a bust are the route to the bust.

We cannot know how a Trump cycle ends, but we can make educated guesses.

The risk of pro-growth, pro-investment, protectionist policies is that the stresses created by demands on money markets, to fund expansion, or on prices through inflation cause interest rates to climb and liquidity to tighten.

Gold is an asset that will do well when liquidity is high, and or inflation is high, which is often the same thing. Those foreign governments which are seeking to defend an economy exposed to financial sanctions, such as Russia, or China, may buy gold as their means to protect their assets from confiscation.

You can buy physical gold, but I am happy to own a respected ETF such as IAU.

Cryptocurrency performs a similar function to those who worry about a government that may choose to inflate away sovereign debt via domestic inflation.

One might consider either, but I prefer gold for a less wild ride.

The other asset to consider is USD cash. One could try and open a bank account, but foreign bank accounts, especially in the USA, are a pain to have your name on.

The better choice is something you can buy in a brokerage account which you can easily trade for other assets in your portfolio. One good choice is a short maturity Treasury bill portfolio, such as an Exchange Traded Fund (ETF).

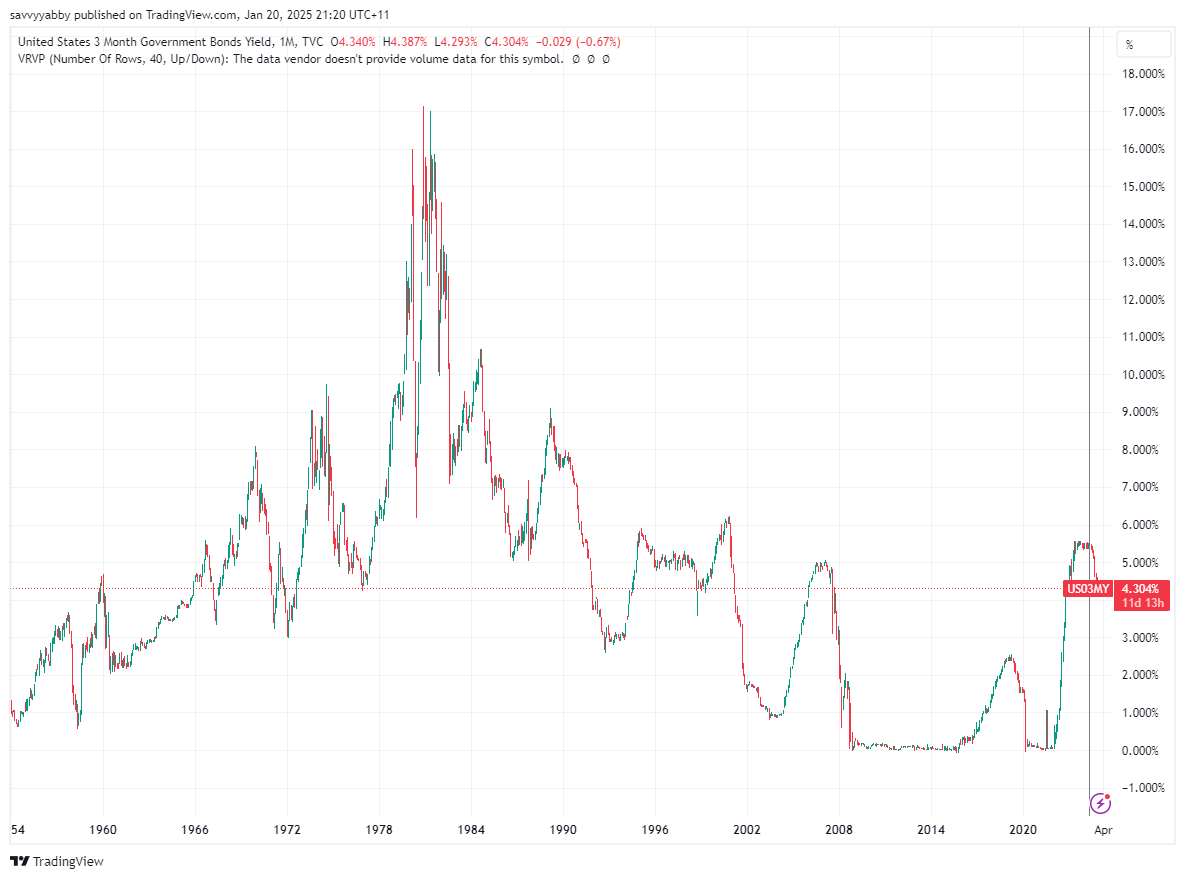

The U.S. Treasury issues 90-day maturity bills. For many years these paid rates of interest that were close to zero, due to central bank stimulus. However, rates are higher now, due to the recent inflationary pulse in global markets.

The interest rate, or running yield, is now around 4.28%.

These are not like term deposits. You can realize liquidity by selling the instrument, and the capital values will fluctuate, along with an effect called accrued interest.

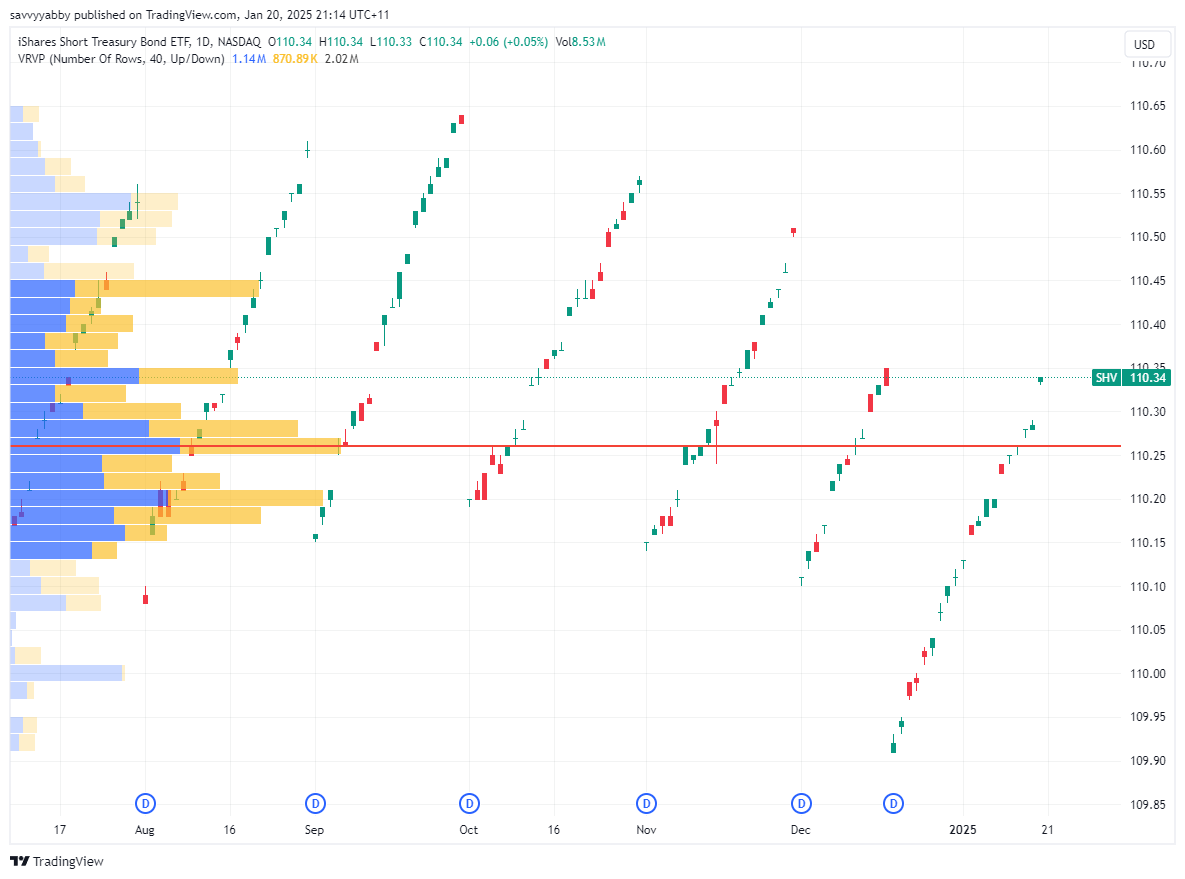

In the diagram above I show the current price for the iShares Short Treasury Bond ETF, whose US ticker is SHV. Notice the sawtooth price pattern. This goes up and down over 90-day cycles reflecting regular interest payments. You are paying anybody selling for the right to own the asset, mindful of when interest is paid.

Obviously, when interest has just been paid the ETF goes down in value, just like a stock that has gone ex-dividend, but then rises in anticipation of the next payday.

Since this is a fund, which never matures, the old bills are replaced with new bills, and the interest will adjust to reflect market conditions. There is a 3M Treasury Bill series which tracks the yield over time, and that adjusts to reflect demand for money.

Notice that for much of the last sixty years the interest rate was above 3%, but that it went below that to hover around 0% for the period after the GFC. The inflation that returned after COVID-19 disruptions saw it return to levels above 4%.

The policies of Donald Trump, particularly the permanent tax cuts, and the expansion of investment in new manufacturing are likely to put a floor under rates. The end we alluded to, in the sense of a cycle turning down, usually comes with higher rates.

In this cycle, interest rates above 5% look damaging, but more so if that is long term interest rates that affect government finances over the long term. There is no hard and fast science to this, but 10-year bond rates much above 5% would pose risks related to the market appetite to keep lending the U.S. government money.

The U.S. government debt is now in excess of 100% of GDP. For finance rates over 5% the U.S. government needs to pay away 5% of GDP each year in interest. Markets are less worried about this in the early stages of an expansion, than later.

The Biden Inflation Reduction Act (IRA) saw a lot of money go into new manufacturing facilities in the USA. Once Donald Trump gets moving with his policies the demand for money to fund this is likely to rise. We cannot foresee when this gets to be too much but can point to the US short-term bill as a relatively safe place to hide.

When interest rates go up on longer maturity bonds, capital values fall. The value of the fund can go down. The iShares 10-20 Year Treasury Bond ETF TLH fell 40% in capital value over the last five years, as interest rates went up.

Due to the unknown outcomes of Trump policy, but the likely expansionary settings, there is a likely risk of yet higher rates at some point, which makes bonds risky.

The 10-year bond yield is a benchmark rate for valuing stocks and also gauging the impact on the viability of U.S. debt ratios. Generally speaking, central banks have considered inflation in the 2-3% range to be a sweet spot.

For long-term bond yields between 3 and 5%, this means the real rate of interest is hovering around 2% plus or minus a percent or so. When you go much lower the risks point to an inflation breakout, when higher you are looking at recession.

Low real interest rates are stimulatory. High real rates signal a contraction.

The U.S. has been running a large budget deficit of 6% or so during the Biden years and Trump is proposing to cut taxes. The central case for an “end” to this cycle is an inflation break-out, followed by higher rates. Sustained U.S. interest rates above 5% start to look worrying. With Trump-the-Showman at the helm, you may survive 6%. However, I do not think expensive long-duration technology stocks could survive rarefied interest rate peaks for very long. There would be a serious correction.

Note that the 1970s stagflation cycle saw central banks lose control of monetary conditions with a runaway inflation. That is a real risk with Trump policy.

For this reason, we would keep some gold exposure.

Conclusion

In this note, we kicked off the upcoming presidential inauguration with a simple view on the likely macro-positive effects of tax cuts at the start of this journey.

I think it is helpful to keep things simple and focus on the broad S&P 500 exposure to begin with simply because most of the early juice will come from funds inflow.

The USD is likely to be bought, and foreign managers risk not owning a U.S. rally.

The middle phase, of sifting through policy effects on single stocks and industries could come quite soon, but we think it is important not to miss the macro boost.

For instance, worries about what may go wrong in a Trump presidency may surface quite early, but they are more likely to involve assets which hedge those risks.

This is why we think it is worth owning some gold, even from the beginning.

However, the reason for owning it is the hedging done by other global players as they react to Trump policies, especially on tariffs, sanctions, and the status of the USD.

Progress on the Ukraine-Russia war will also matter here.

Finally, there is an obvious asset to own whenever the stock market cycle becomes over-extended, namely cash. Since this is likely to be strong USD cycle, we prefer unhedged US short-term money, with no credit risk. That is Treasury Bills.

The majority of ASX listed ETF products seem to be hedged. This does make sense for a long-term buy and hold position in bonds, but not for a tactical position in bills.

I will have more to say on this later, but usually a strong-dollar cycle rolls over once money tightens in the USA, but this happens earlier outside the USA. This means Australian dollars, and US bills hedged into Australian dollars are not ideal.

You actually want to benefit from both U.S. interest rates and a strong currency.

Profits in this cycle can then be repatriated back to Australian dollars.

I will do risk analysis of these core ETFs, IVV (S&P 500), IAU (Gold) and SHV (Bills) in a further note, before we get down to analyze the early policy announcements.