Best Global Idea: ASX Gold Stocks

The die is cast now. We are in a precious metals bull market led by gold and ASX listed gold miners are in the box seat. We lay out the case, and our top picks.

We take time out from our tour of the Solar System to zero in on opportunity.

I have been a global investor for thirty years, and mostly my best ideas are in stock markets outside of Australia. This is not for lack of patriotism. It just works for me.

This time is different; I am bringing capital back home to the ASX.

This is because Australia has many great gold companies, and our currency dynamics favor owning gold miners operating in low-cost jurisdictions, like Western Australia.

Australia, and parts of Africa, namely West Africa, are great for that.

In the introduction, I reprise the supporting case for gold, the metal, and then I will do a deep dive on ASX listed gold producers, for the purpose of locating best ideas.

Once this bull market develops fully (Australian fund managers generally avoid mining stocks, especially gold miners) we will look at gold explorers.

However, first things first. Get set in a bouquet of profitable gold producers.

The case for gold

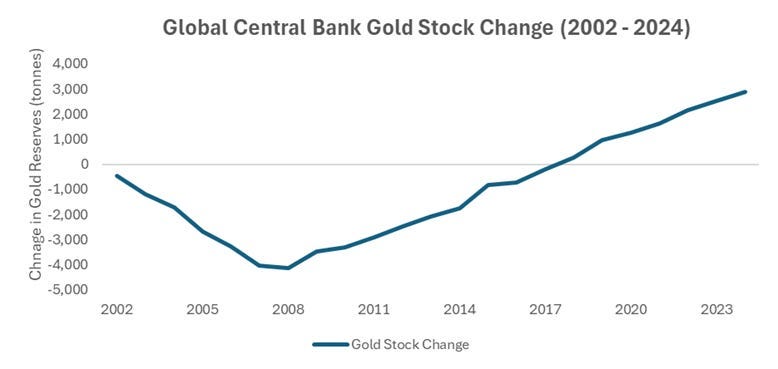

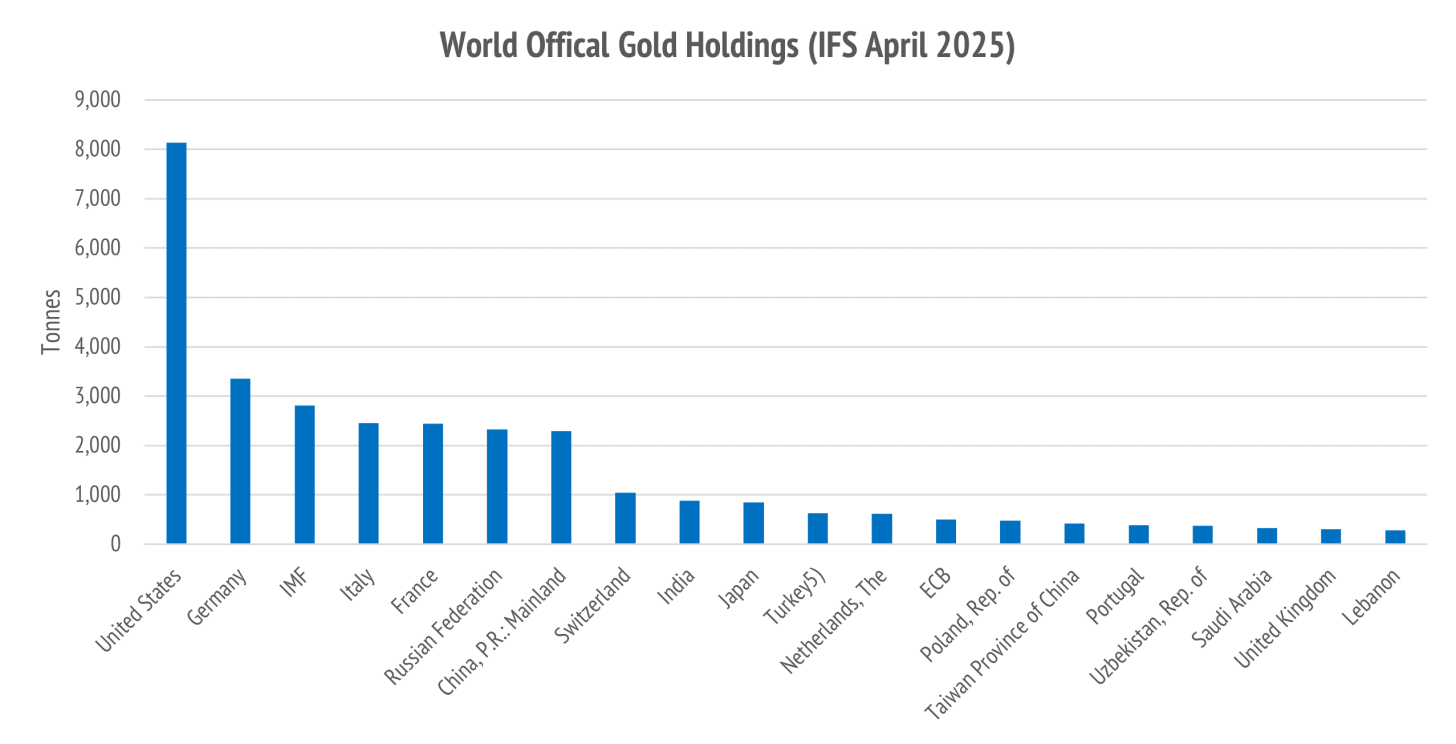

In my last post, The Global Themescape: Sol, I shared this chart detailing the change in central bank buying behavior for gold since the Global Financial Crisis (GFC).

Not every central bank changed behavior. According to public records, the US Federal Reserve has not changed gold reserves in decades. The bulk of the new buying was in emerging market central banks, particularly Russia and China.

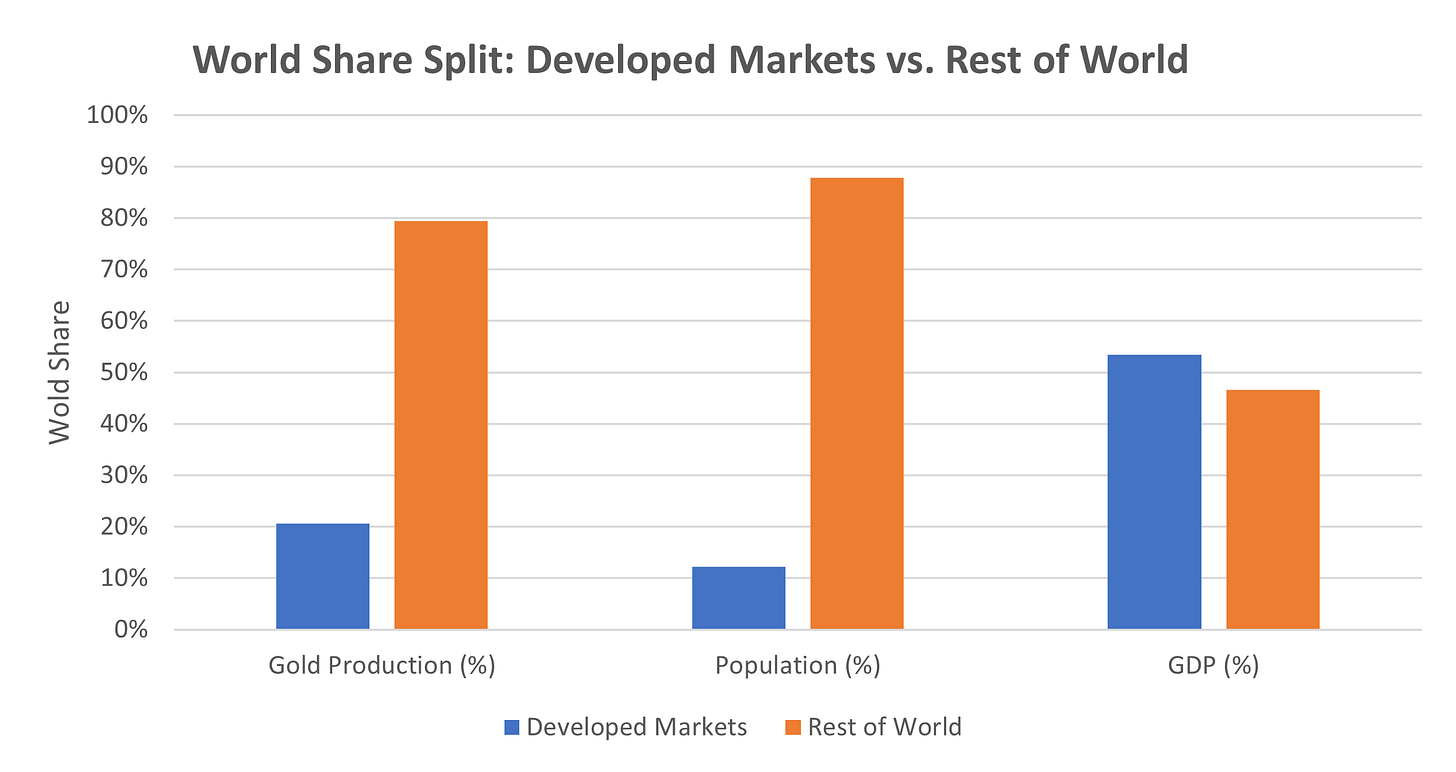

It might seem odd that emerging markets are buying gold, until you clock the global geography of gold production, population share, and GDP share.

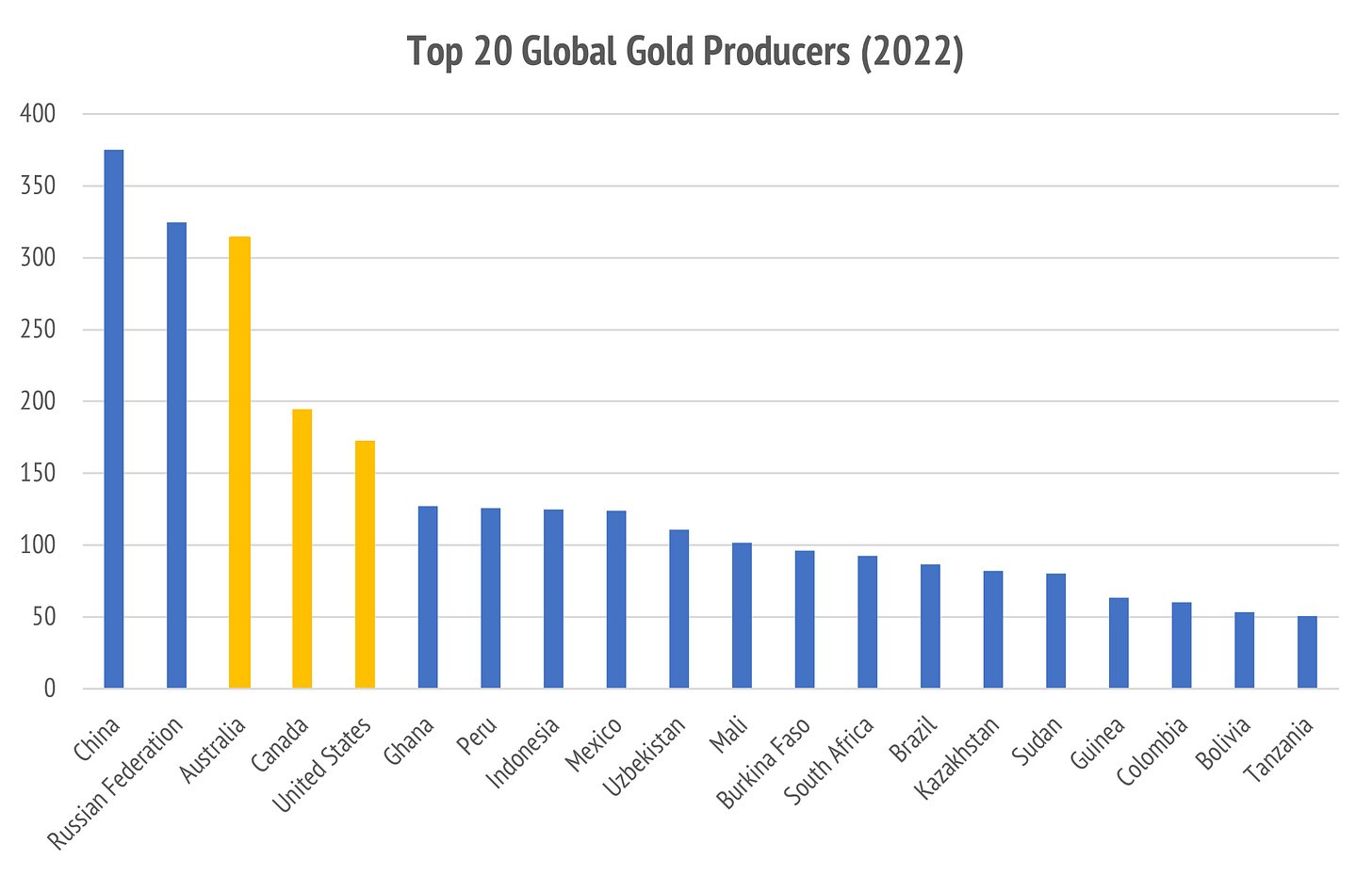

Only three of the top 20 gold producers are developed nations.

Evidently, emerging markets dominate gold production and have close to half of all national purchasing power as represented by aggregate GDP.

In a world which is nervous about the USA weaponizing control of the US Dollar, there is an obvious reason for nations outside the US security orbit to stack gold.

Interestingly, this is not a dynamic that is likely to upset the USA as it has far and away the largest central bank holdings and is itself a significant gold producer.

This is why I do not think the US Dollar is likely to stop being the reserve currency any day soon, because the USA still has the largest reserves of monetary gold.

Furthermore, the USA could easily add to that gold reserve, if it wanted to, because it is a large gold producer, and has good relations with both Australia and Canada.

(Note to self: maybe that last bit was wrong).

The short version of this is that gold buying by foreign central banks only increases the value of gold in Fort Knox, and that still in the ground under Nevada.

Arguably, for the amount of gold that they already produce, Russia and China hold too little gold in their official reserves, especially since Russia was cut out of SWIFT and China is the subject of a no-holds barred trade war.

I expect this trend of global official gold hoarding to continue.

Some will say Bitcoin is preferable.

You can buy that, but I am sticking to gold because I think the fate of cryptocurrency is too closely intertwined with semiconductors. The valuation is anchored in scarcity that is artificial, because you could restart Bitcoin at zero any day, and vulnerable, because you need access to high-performance computing to run the network.

I cannot see emerging nations flocking to Bitcoin when the US Administration has already shown their hand on dividing the world into semiconductor haves versus semiconductor have nots. This is no foundation for monetary confidence.

The comparative returns

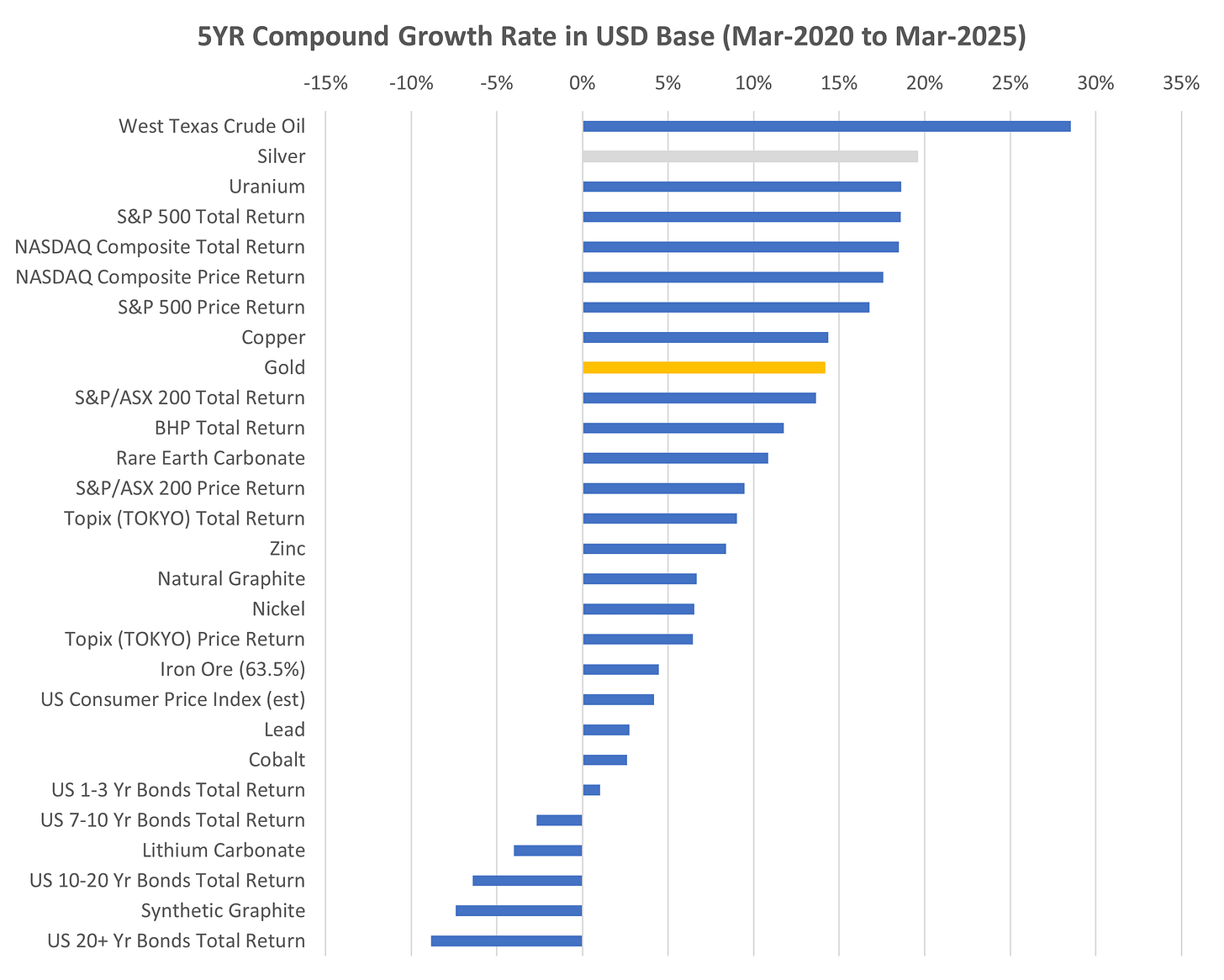

Recent asset returns are no sure guide to the future return.

However, the trends in return over time can be revealing.

The standout horror story over five years has been US bonds. Interest rates were too low, and bond investor suffered as the bond values repriced down as rates rose.

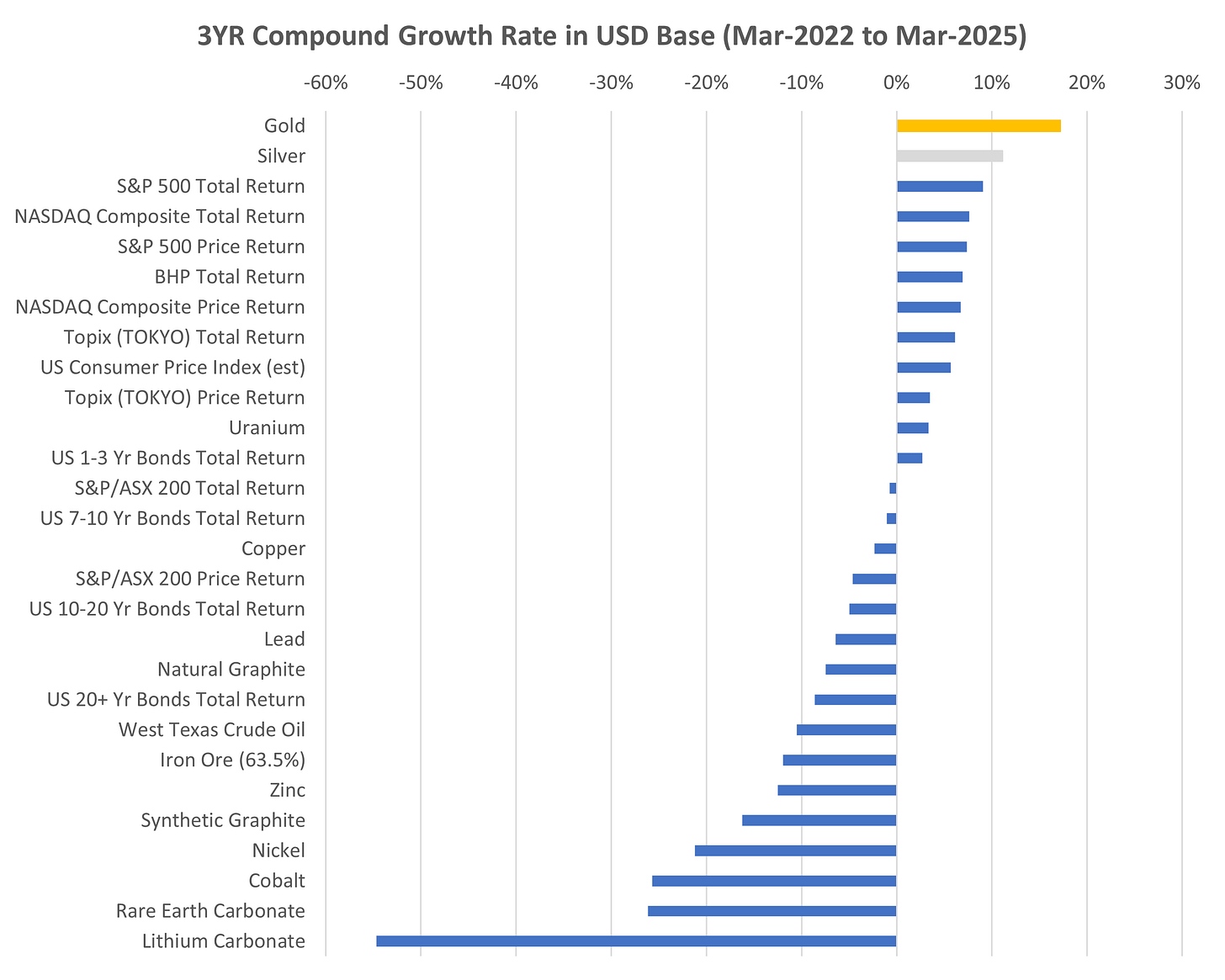

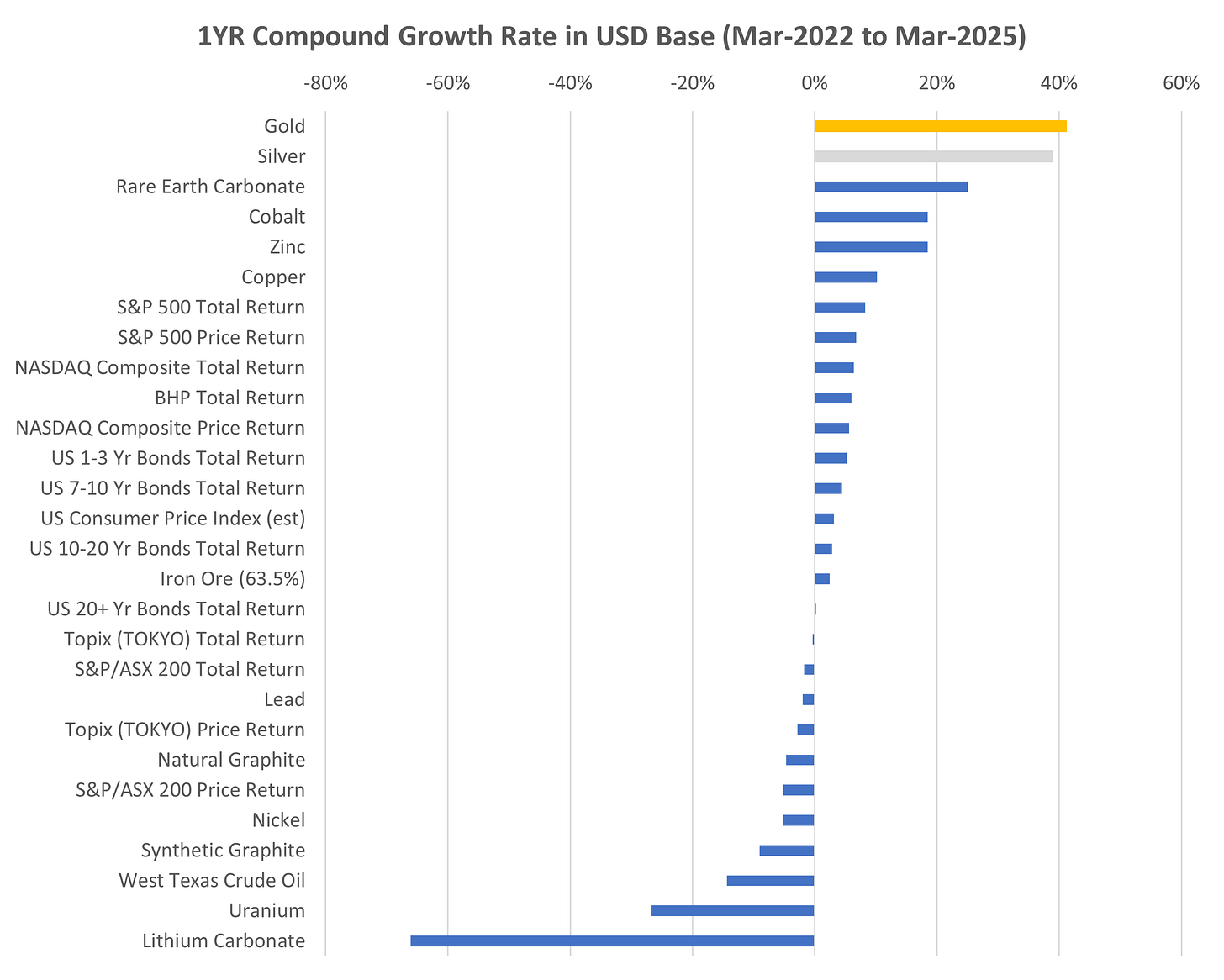

There are many investors who probably did not clock that. Gold has been the place to be for three years already. Markets are like that. They are built to shock you.

Illiquid commodities like rare earth concentrate and lithium carbonate will move a lot as the industrial production cycle plays out. However, look at gold, silver and copper. These are not small markets, and they have all handily beaten stock indices.

The big concern now, which has only accelerated since Liberation Day, is that the USA has created perfect conditions for stagflation. This involves persistent inflation, and a toxic combination of low growth and high unemployment.

The last time we saw that was the 1970s after President Richard Nixon blew up the Bretton Woods monetary system. Now President Donald Trump blew up trade.

This is not a small thing. There will be a heavy financial price to pay.

Already, we see that gold is playing a safe haven role.

The case for gold miners

Gold miners produce gold, but the stockholders are not going to be rewarded unless the companies can make a profit. This has sometimes been hard for gold miners.

Rising energy prices, steel costs, and labour costs, can cruel profits.

However, China has excess steel capacity, and oil and diesel costs are contained.

There is the matter of labour costs, but with the former critical minerals boom fading in Australia, and iron ore markets soft, labour prices seem to be under control.

There are always risks to that, but we think that gold miners are doing fine.

The role of costs and margin

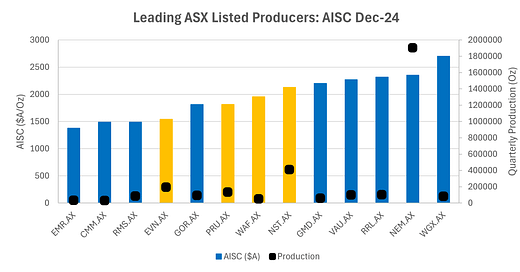

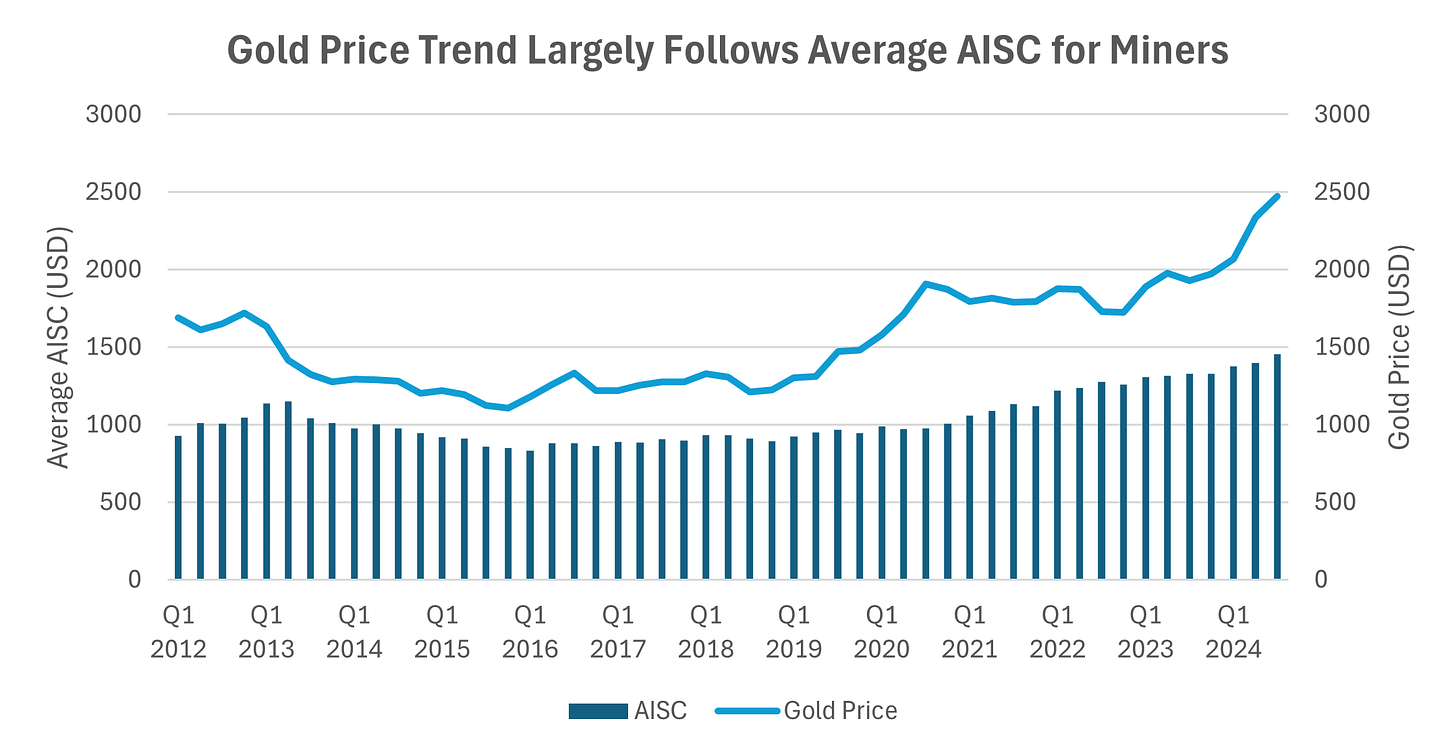

The shorthand metric used by all gold analysts to judge mine profitability, from a back of the envelope standpoint, is the All-In Sustaining Cost (AISC), which includes costs related to operating the mine, plus amortized capital expenditure (ex-cleanup).

Under normal conditions the gold price trend follows the global average AISC.

It could happen differently from this because most gold ever mined is sitting in vaults and could easily be sold into the market to balance supply and demand.

However, we mentioned that central banks are consistently buying gold. The buyer with the most and best purchasing power seeks more gold and not less.

The current trend will likely continue until that behaviour changes.

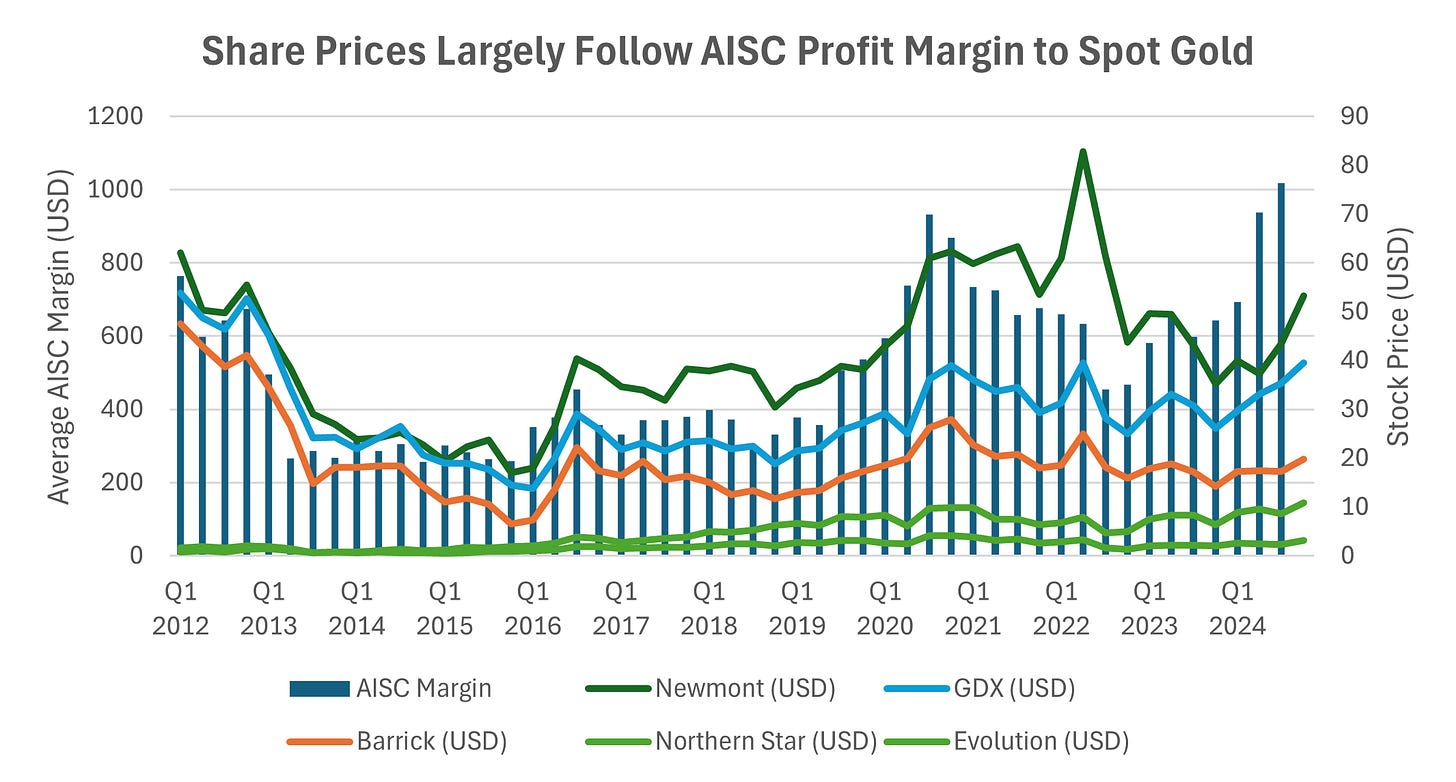

The difference between the spot price and the AISC is an approximation to the profit margin made by the gold miner. In general, share prices follow this trend.

Once you understand these basic principles, it becomes possible to locate which of the currently operating gold producers may have the right combination of:

Sustainable profit margins for gold sold above cost of production

Growth options through higher production and or exploration upside

Diversification by mine and geography to reduce operational risk

The stocks targeted in this manner may not have the greatest return upside from the fluctuations in gold price, exploration progress, or capital events like takeovers.

However, in a major bull market that is underpinned by geopolitical tension, our goal is to take sizeable positions in liquid companies whose fortunes are clearer.

Mining is a risky business, so it pays to diversify.

This does not mean we have no interest in promising explorers and mine developers. On the contrary, these can make for excellent supplementary positions.

However, it is very important to get the core of the portfolio right.

On to a survey of the S&P/ASX 200 gold stock universe.

Keep reading with a 7-day free trial

Subscribe to The Savvy Yabby Report to keep reading this post and get 7 days of free access to the full post archives.