China Tech and European Financials

The new year has opened with some major contrarian moves in global markets. The market noise is American. The market action and value are in China tech XNAS: TCHI and European financials XNAS: EUFN.

This is a contrarian wire, and I have a confession to make.

We overlooked a big potential move in our start-of-year commentary.

In our general focus on the big picture positioning of a core portfolio, we have been tardy to add some meaningful satellite positions for a contrarian uplift.

Mea Culpa.

The best thing to do when you make a mistake is to correct it.

In this edition, we survey value in global markets and (re)position to catch some of the value and momentum on offer in the Trump 2.0 era, where Americans “Buy American”, and other folks look for ways and means to “Not Buy American”.

I think you should buy both, and benefit from the best in each market.

Last year it was unclear that the global investor community felt the same.

However, approaching the end of the second month of this year it is a good time to take stock, assess the big moves, and see which have the legs to follow through.

Squeezing the Water Balloon

The opening weeks of the Trump 2.0 presidency have assured us all that “America First” is not simply a campaign statement, but a dyed-in-the-wool sea change.

This may not prove to be a bad thing for Americans, and for the future of the USA.

I lack the powers of foresight to know how this turns out.

However, as I flagged in my earlier articles, it could end poorly with an inflation break out and an even more fractured US polity. That outcome now seems possible.

With this in mind and recognizing the extraordinary dominance of US technology stocks in global market capitalization rankings, global investors now seem to be actively searching for new opportunities to diversify into non-US value stocks.

It is worth surveying global markets for value and price momentum.

The quantitative sweet spot is usually to buy good value off the back of sustained price momentum. This is more reliable when supported by earnings growth.

The best reason I can offer is real markets are like a water balloon.

When you squeeze them, the water wants to go somewhere. If the balloon is not too inflated the water will bulge out the side, wherever the resistance is the least.

Squeeze too hard and the water balloon will burst.

In this market analogy, the water is liquidity. When liquidity is ample, the economy will grow, and there is upward pressure on prices. If money tightens quickly the balloon can burst, the liquidity drains away, and asset prices will fall sharply.

The USA is running a large budget deficit, and China is opting for continued stimulus also. Europe looks set to commit to spend a lot more money on NATO defense.

There is a sizeable global liquidity impulse at a time when US interest rates are being managed downwards by the incoming Secretary of the Treasury, Scott Bessent.

The other factor of importance is the elevated global share of US asset markets. Even a small reallocation away from expensive US markets can lift non-US asset prices.

What does the global value picture look like?

When global funds managers are rotating portfolios, they typically look for pockets of value with improving fundamentals and positive price momentum. Looking first at the country valuations across developed and emerging markets Hong Kong stands out as cheap, especially when compared to mainland China.

The most expensive emerging market is India, and the China mainland market looks more expensive than the Hong Kong market. They are different stocks, but this is where we should look for some value. Go bargain hunting in Hong Kong!

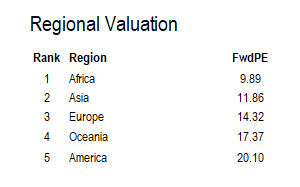

Notice that Australia is not a cheap market, but much of Europe is undemanding. This is clear when the data is recut to focus on regional valuations.

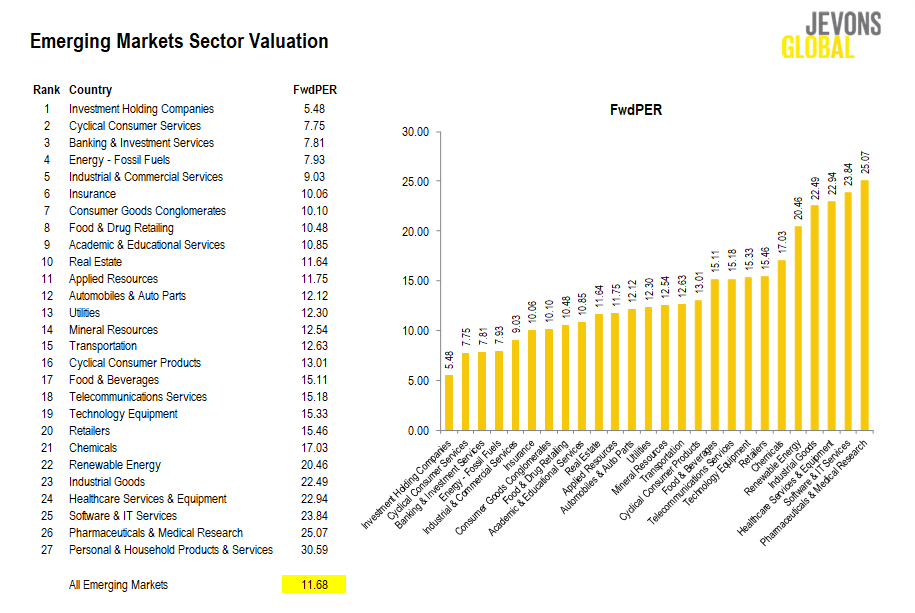

The second axis on which to dice value is by sector.

Notice that Technology Equipment has high expectations impounded in valuations, along with Fintech, while mainline banking and insurance are cheap.

One worthy line of research is to ask the question:

Will Generative Artificial Intelligence benefit banking and insurance?

In the age of DeepSeek R2, and Open-Source software, I think the answer is yes.

Having spent decades inside investment banks and funds management firms much of the grunt work is document processing, and this just took a giant leap forward.

Unlike global healthcare, which is another likely beneficiary, global finance is cheap.

Doing the same sector valuation across emerging markets also suggests finance.

On a comparative basis, Technology Equipment is cheaper in emerging markets, while the Software and Services sector is roughly the same. There may be relative value in emerging market technology, but clearly one must be selective.

Our conclusion is two-fold:

Look at Hong Kong for general value

Look at global finance for sector value and perhaps in cheaper markets

The qualification on the second point is warranted when we consider the position in Australian banks. These are expensive by global standards.

How does price momentum look?

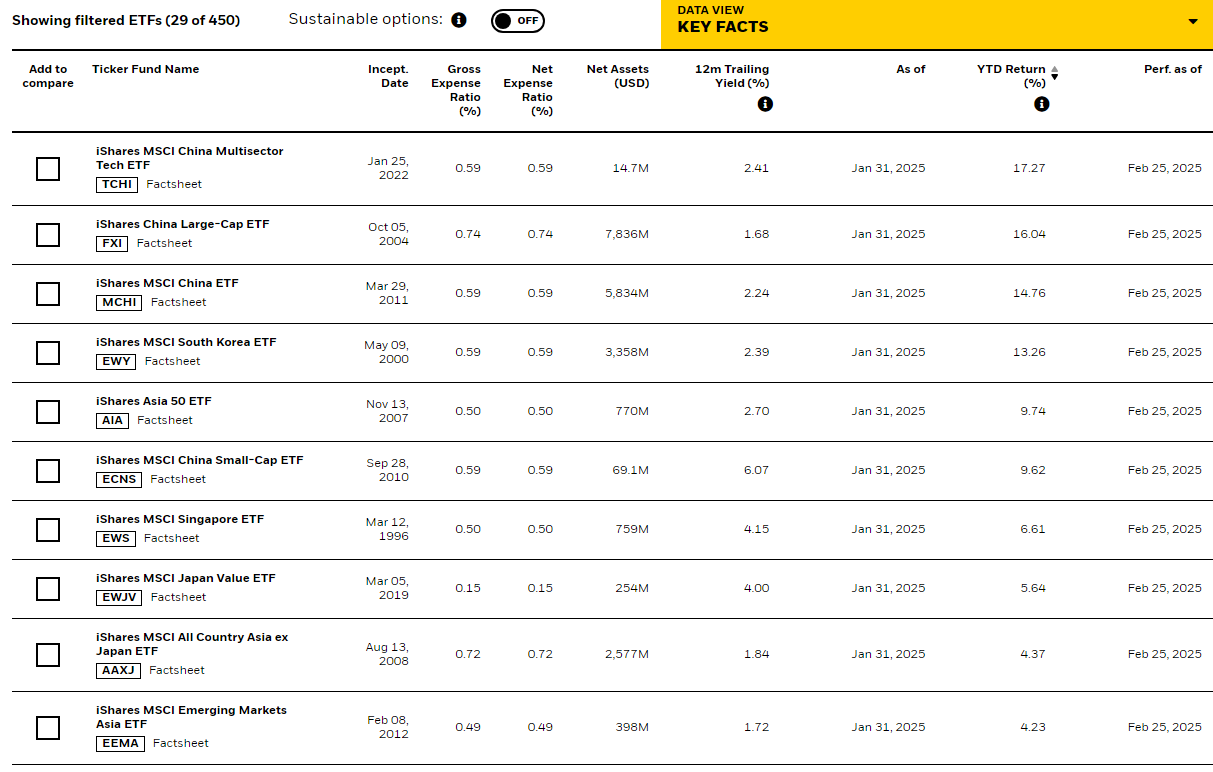

The easiest way to check price momentum is to track an ETF leader board. The top ten year to date performers in Asia-Pacific are led by a China tech ETF XNAS: TCHI.

The release of DeepSeek really challenged Western perceptions that China technology is inferior, and that innovation only ever happens in Silicon Valley. Myth busted!

Another popular piece of mythology is that Europe is a bad investment destination.

The above top ten performers represent European ETFs. Note that number three is a sector ETF focused on European financials, XNAS: EUFN.

There you have two simple ETF selections which play to global areas of value. The USA market performance has been dominated by healthcare, not technology.

Healthcare is one place to look for US opportunity outside the Magnificent Seven, but there are risks with the activist program of Trump Health and Human Services chief Robert F. Kennedy Jr. who seems intent on shaking things up.

Conclusion

In this global survey, we highlighted that global finance is a showing attractive value, at the sector level, with European financials being clear targets of rotation.

Our top ETF selection is the iShares MSCI Europe Financials ETF XNAS: EUFN.

The other standout is the Hong Kong market and a resurgent China technology sector.

Our top ETF selection is the iShares MSCI China Multisector Tech ETF XNAS: TCHI.

These can be bought in a US broker account as they are listed in the USA.

You may find some viable exposures on the ASX ETP list. However, I prefer to buy ETFs in the USA as the selection is wider and the market spreads are lower.

This weekend I will do a follow-up paid subscriber note to unbox the EUFN and TCHI products to look at individual stock ideas. These are typically listed in Europe or Asia. You will need a global brokerage account to action those ideas.

In Australia, I have used Interactive Brokers and SAXO Bank.

These are not product endorsements, just a reflection of what I have used personally.

Look around online for comparison shopping.

The portfolio tracking website service Sharesight is a good place to start. This helps you to track a portfolio in multiple currencies, and your tax liability, plus income.

One good way to surface brokers is by looking at their partner list. You need a solid feed from your broker trading account to your chosen portfolio tracker. Reviewing supported broker options and taking a free trial is a good way to research this.

Again, these are not product endorsements, and you must do your own research.

This substack is not paid by any third party to influence your buying decisions.

You pay us through subscriber revenues, and we aim to be helpful.

If you would like more research on broker options say so in the comments.

Good luck and happy investing!

Hi Yabby, no pressure, but are you still going to pull apart those 2 ETFs and look at some of the individual companies?

Just asking!

We do appreciate and enjoy your commentary.

Regards,

Jeff

Thanks Yabby, seek enjoy your article over a coffee in Chang Sha.