Enter the Yabby... Our Origin Story

How a market train wreck, and a broker prank, led to the Savvy Yabby indicator.

The Savvy Yabby solves a problem most investors don’t know they have.

Through the magic of evolution, we are social animals of high cognitive ability who are prone to a slew of behavioral quirks that are hazardous in financial markets.

The key investor issue is an unwillingness to admit when are wrong.

Everybody I know shares this trait, especially me.

It is human.

The problem about being wrong in a financial market is obvious.

You lose money.

Anybody can be wrong for a host of reasons. However, since the financial market is a broad arena, and we are social animals, we are often wrong together.

It feels better to follow a crowd, and sometimes the crowd is just wrong.

Let me illustrate with a personal investing story.

The 2000 tech-wreck and my journey from right, to wrong, to wronger, to out

I will tell you a story about my own investing experience in the 2000 tech-wreck.

Once you hear this story, you will Enter the Yabby.

It will become clear why it exists, and what assistance it can provide to you.

Long ago, I met a Viking on a train in Kashmir.

After many voyages, to land on foreign beaches, we settled down to buy some shares.

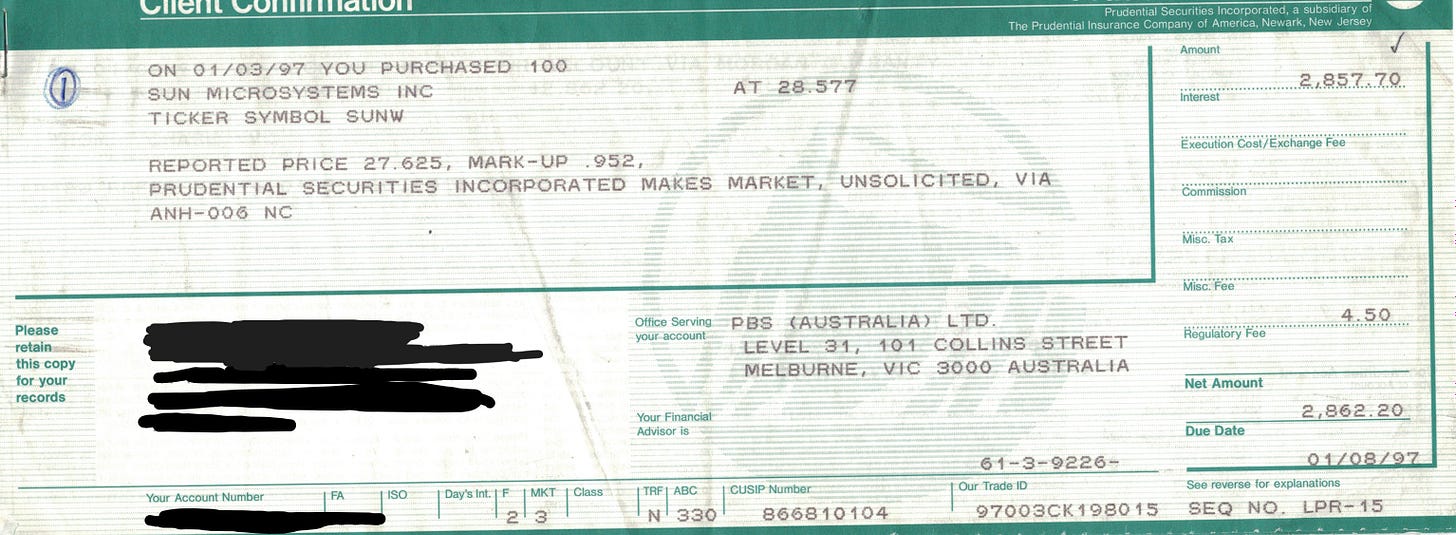

This is the contract note for our first purchase of US stock, way back in 1997.

That was SUN Microsystems.

I was fooling with SUN workstations in military research and development.

The Viking was operations manager for a software firm that used them for databases.

SUN was the poster child of the internet boom.

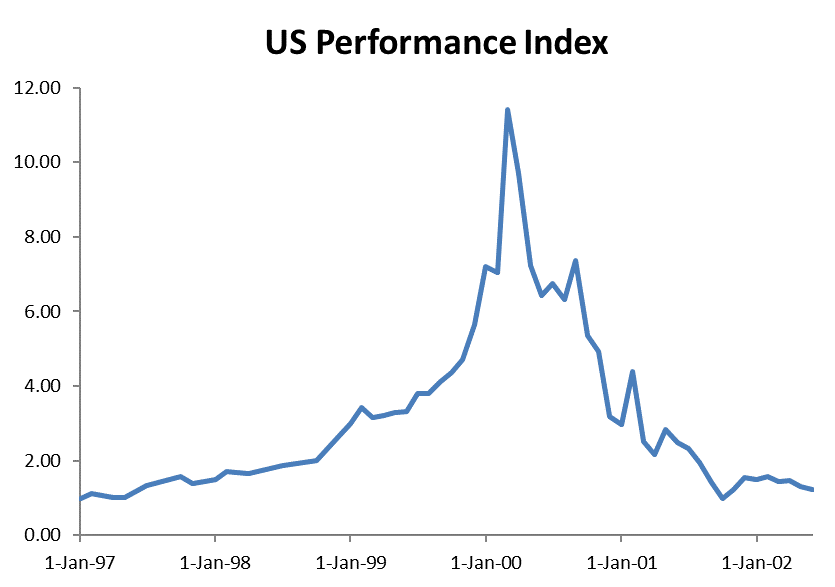

The stock went up, a lot.

We did not only own SUNW stock, but a lot of other internet heroes.

They went up, almost as much.

The portfolio was wildly successful, so we geared it with money borrowed on margin.

This rocket fuel propelled the whole shebang into the stratosphere.

We went on holiday in San Francisco. I took a shower.

Honey, guess what? We made 40,000 dollars while you were in the shower!

Bull markets are like that.

You are on a huge winner, along with the crowd. Everybody was Internet happy.

The Yabby and The Viking were right about one huge thing.

The network was the computer, after all.

Least ways, it was until it wasn’t.

The open-source Linux platform arrived and totally nixed proprietary Unix systems.

We were right, very right, until we were wrong.

Our margin loans soon made us wronger, and then some.

I can laugh about this now. So should you. It was our money, not that of investors.

WTF? What were they thinking?

The five-year ARK Innovation ETF chart looks as bad, and probably for similar reasons.

When the world changes, we need to take stock and change with it.

Understanding ourselves, and investor psychology, can help.

Should you trust a broker to run a pet shop?

Long enough ago, beyond the sunset of any statute of limitations, an enterprising analyst, who happened to be extremely good, salted his research with recipes.

One famous research piece included his favorite recipes to cook a yabby.

It is said, although nobody will freely admit this, that each research report was duly accompanied by a live yabby, complete with fish tank, by special delivery.

I deny any direct knowledge of this event. It was a competitor broking firm.

However, our team did hear tell of an escaped yabby doing the rounds of one client.

We dubbed this culinary escapee “The Savvy Yabby”.

It was the one that got away.

The one that might well die in the client corner office, never to be eaten.

Tax-loss selling season, vintage 2002

Generally speaking, investors will care about whether they make or lose money on an individual share purchase. The profit and loss for each position you own is generally shown in your brokerage account. This is how we tell our winners from losers.

In those days, I ran a quantitative research team. I had been working on a new way to forecast tax-loss selling at financial year end. Investors reduce their capital gains tax liability by selling losers to offset any winners.

This tax-driven selling hits the weaker stocks in June, and they often bounce in July.

In the past, analysts did simple things like calculate the average price that stocks had been traded over the last year. If you were above that in June, then investors most likely had unrealized profits. If below, they most likely nursed losses.

Furthermore, it is common for investors to hold on to losers in the hope that they will recover to break even. Conversely, they are often prone to take profits in winners.

This common behavior is the source of a famous broker adage.

Cut your losses early and let your winners run.

This is a hard rule to follow, and we often behave oppositely.

We simply cannot bear to sell the loser, and admit we were wrong.

Selling winners feels better, because we capture the profit, and are proven right.

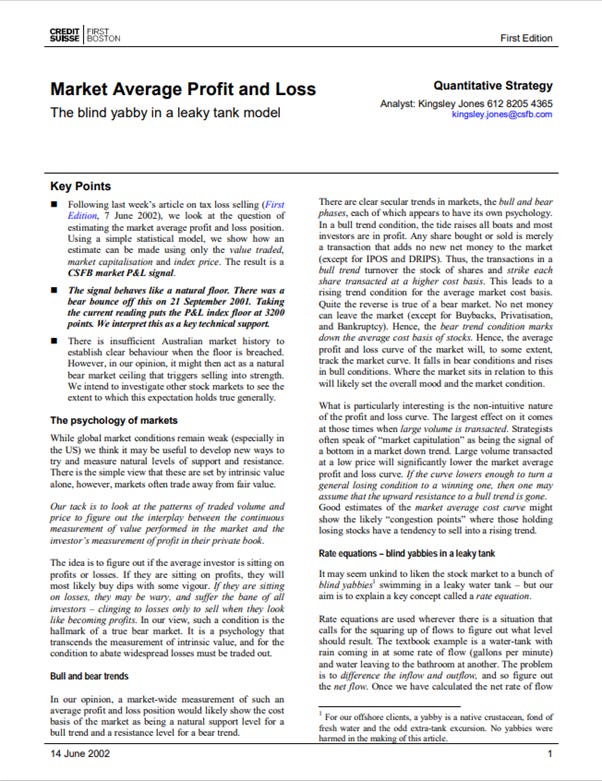

When writing my annual tax-loss selling report, back in June 2002, I had a brainwave.

Maybe you could do a better job on estimating the average cost of entry?

Since I had been unable to admit defeat during the tech-wreck, I reasoned that most investors behave in a similar fashion. They do not want to realize a loss by selling.

Surely, I reasoned, if I knew what other people had paid for their stock, I would know whether I was wrong alone, or wrong in a crowd of generally wrong people.

This is important, because we are such social animals.

If you are wrong alone, then nobody ever needs to know.

You can just sell and feel no shame. Just stem the bleeding and move on.

However, if you are wrong in a crowd of wrong people you have a problem.

There is too much moral support in a crowd of wrong people for you to get out.

We none of us like to admit we are wrong.

In a crowd of wrong people, most will agree that it is the market that is wrong.

This makes it very difficult to do the prudent thing and to cut your losses.

The opposite is true of any boom whenever the naysayers are not in.

Know yourself. Know the crowd. Know what is going on in the world at large.

Make up your own mind when to be contrarian, and when not.

Enter The Savvy Yabby Indicator

The key to my brainwave was a simple insight.

All shares of a company are owned by somebody, purchased at some past traded price. For publicly traded stocks, we actually know all of the past traded prices.

This market fact has a surprising consequence.

The distribution of currently held shares only has peaks at past traded prices.

The distribution of prices traded has no peaks where the stock never traded, only gaps.

Therefore, we know a lot about the distribution of investor entry prices. This can be learned by looking at the volume history of all trades struck at different prices.

The thing we don’t know is how many shares were bought at each different price.

Obviously, the more shares issued that are traded, the more likely a share bought long ago will have changed hands. When you follow this thought further, it is clear that the proportion of shares traded, on any given day will affect the memory of past prices.

Pow!

Pretty soon, I had my indicator to estimate the unrealized profit and loss for any publicly traded stock. It turned out to be a type of technical indicator called an exponential moving average. These are very well-known and widely used.

The difference for the Profit and Loss Indicator was that the so-called speed, or window-length, of the moving average depending on market turnover.

Mathematics is not the best language to communicate to a financial audience. It may be natural to those trained in theoretical physics, but not for everybody.

This was June 2002, soon after one Savvy Yabby went over the wire at Stalag AMP.

Analogies can help bridge the gap for understanding.

I asked my buttoned-down institutional readers to imagine a bunch of blind yabbies in a leaky water tank, with some leaving via the drainpipe and going back in the top, as fresh yabbies, being the same share with a new owner.

You can read the original article here.

The factor which determines the speed of blind yabby replacement, as a metaphor for how shares on the register randomly pass from one owner to a new one, is just the rate at which shares are traded. Trade faster and all the yabbies get younger.

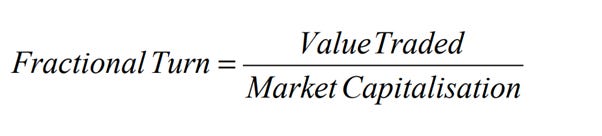

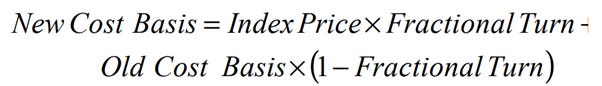

The actual calculation is simple.

On any given day, you look at the proportion of the total shares traded. This is the value traded that day, divided by the total market capitalization.

Then you update your previous estimate of the average entry price by taking some part of the old estimate and adding in the average traded price for that day.

In a nutshell, if the price traded today was $1.10 and 10% of shares changed hands, and the old, estimated entry price, was $1, then you take 90% of $1, which is 90c and add that to 10% of $1.10, which is 11c. Add those and you get $1.01.

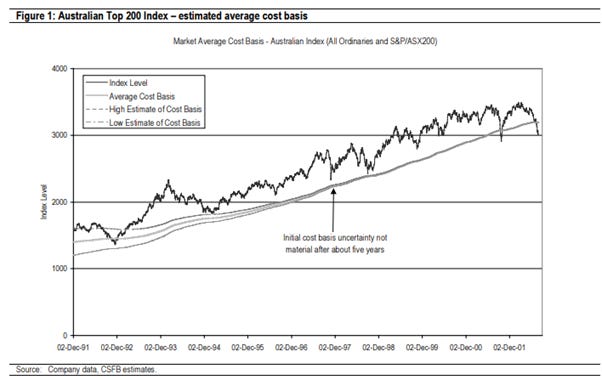

The miracle of this rule is that it is very simple, and it does not matter very much that you do not know where exactly to start the calculation. If your stock had an initial public offering, then you know what price to use. If not just choose the price in the share history from about five years ago.

The financial market loses all memory of the past very quickly.

You can test this, with simple experiments, using real data with prices at the actual price five years ago, and two other prices 10% above or below. The three moving averages will zero in on the same value, after the passage of time.

Here is my original chart, from 31-July-2002, where I showed that to be the case.

The solid dark line is the S&P/ASX 200 index from 1991 to 2002, The gray lines are the estimated investor average cost-of-entry, for the market as a whole. You can see that there are three gray lines that start out different, but eventually converge.

That is the Savvy Yabby Indicator!

Index above the line: bull market - the average investor is in unrealized profit.

Index below the line: bear market - the average investor is in unrealized loss.

This simple property of real markets drives waves of change for investor sentiment.

People, in general, meaning the crowd, think differently depending on the regime.

Decades ago, I showed that the volatility is asymmetric between both regimes.

In bear markets, down days are more likely than up days, and conversely.

I did not actually tell anybody then, but I am telling you now :-)

That is what The Savvy Yabby Report is all about.

Educashion.

Enter Empathic Investing

I made a bold claim at the outset:

The Savvy Yabby solves a problem most investors don’t know they have.

Let me now tie all these story threads together to introduce empathic investing.

The personal story I shared above highlights this conundrum.

Bull markets and bear markets are characterized by vastly different sentiment.

In a bull market, everyone is a winner, and the investor cup is overflowing.

In a bear market, losers abound, and the investor party gives way to hangovers.

When a young couple, such as The Viking, and The Yabby, make out like bandits, they soon think themselves invincible, and are headed for a sobering smackdown.

This is just Life in the market.

However, if you know how others are travelling, which stocks are minting millionaires, and which ones have become heartbreakers, then you are starting ahead.

You will become an empathic investor, able to feel both the pain and joy of others.

This is a skill we all cultivate over time. If you know the source of pain in another, then you are better able to understand their thoughts and actions.

Whenever the investor mind is clouded with guilt, at having made a bad decision, it can become hard to stay rational. The itch to “break even” takes over.

Exuberant markets present a different problem. When all stocks are rising, because all investors feel good, then any explanation for the move will seem rational.

Why disagree with success?

Success has a thousand parents, especially those who bought the stock early.

Elsewhere, I wrote at length about this conundrum of practical investing.

The goal of The Savvy Yabby report is to help connect the emotion that swirls through financial markets with the research that can illuminate what is really going on.

We do not claim to hold all the answers, nor to see the future, but we can help subscribers to view markets through a complementary lens.

Equanimity of mind is the key to sound investing.

You need to know your own mind and that of the crowd.

Then you need to make up your own mind as to who is right.

The Savvy Yabby Indicator can help you to understand the emotional currents in markets. Our research provides the background to make informed decisions.

When you combine these two poles of influence, you get a powerful dynamo for future investing success. Know your own mind, that of others, and then decide.

The Savvy Yabby has its 22nd birthday next Friday 14-Jun-24.

Time to boot the blue crustacean out, and make it earn an honest living.

For this special occasion, there will be a limited time discount.

Enter the Yabby!