Global Themescape: Mars

The overarching thematic of this investment landscape is conflict. We are in the early stages of a US-led global trade war, so it is key to stay sharp on where the action is.

In order to anchor the next series of posts on the Global Themescape, I am going to pick up an astrology thread which relates to the psychology of investing.

This has nothing to do with hokey forecasts based on planetary alignments, but with the symbolism the ancients used when explaining their theories of human action.

Since our theme is action and conflict, we will start with the Planet Mars.

The Artificial Intelligence Oracle of Google Gemini offers this pith on conflict.

In astrology, Mars is often associated with conflict and action, not necessarily peace. While Mars represents the drive to achieve goals and overcome obstacles, it also embodies aggression, assertiveness, and the potential for conflict. However, it's important to consider that Mars's energy can be channeled positively, contributing to a sense of courage, determination, and a pioneering spirit.

Conflict and action are ever present in life, but not always destructive.

The will to action, discovery and invention is a large part of human dynamics. It could be destructive, as in times of war, or it could be constructive, via innovation.

Artificial Intelligence is a defining thematic of our time that is both conflict and action. The contemporary geopolitical dynamic lends itself to this psychographic dynamic.

There is a word for you: psychographic.

Psychographics refers to the study of consumer behaviors and preferences based on psychological factors like values, beliefs, attitudes, and lifestyles. It's a way to understand why people make certain choices and to segment customers based on shared psychological characteristics.

In this series on the Global Themescape, I am going to share with you how I go about slicing and dicing the investment universe to understand current trends.

The Savvy Yabby as Investor Psychology

Since I love classics, and remain a student of Sir Isaac Newton, I will use the planets to explain the mysteries of psychographic preference as they relate to markets.

The reference to Newton has a special place in my heart because this genuine genius made some very bad bets in the South Sea Bubble and dropped a bundle.

It made me feel a lot better to know that Sir Isaac Newton could make out like a loser in a giant financial bubble. I did exactly the same thing in the 2000 tech wreck!

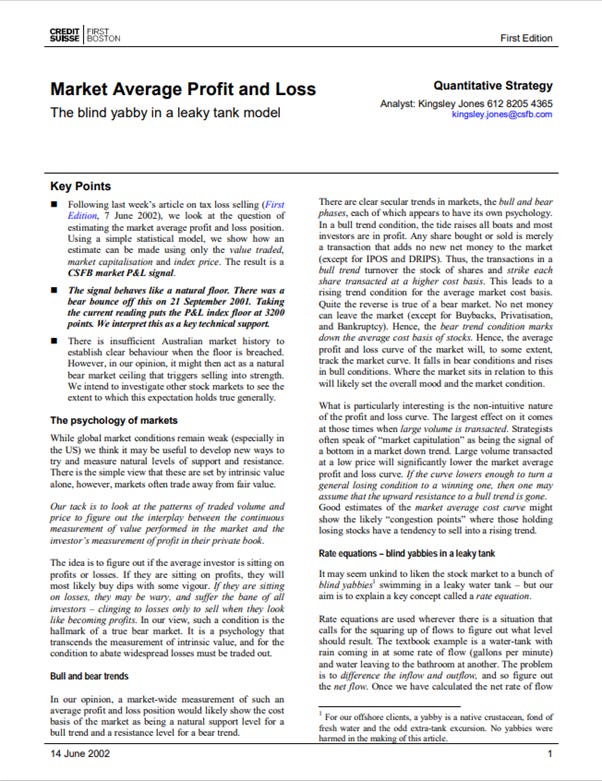

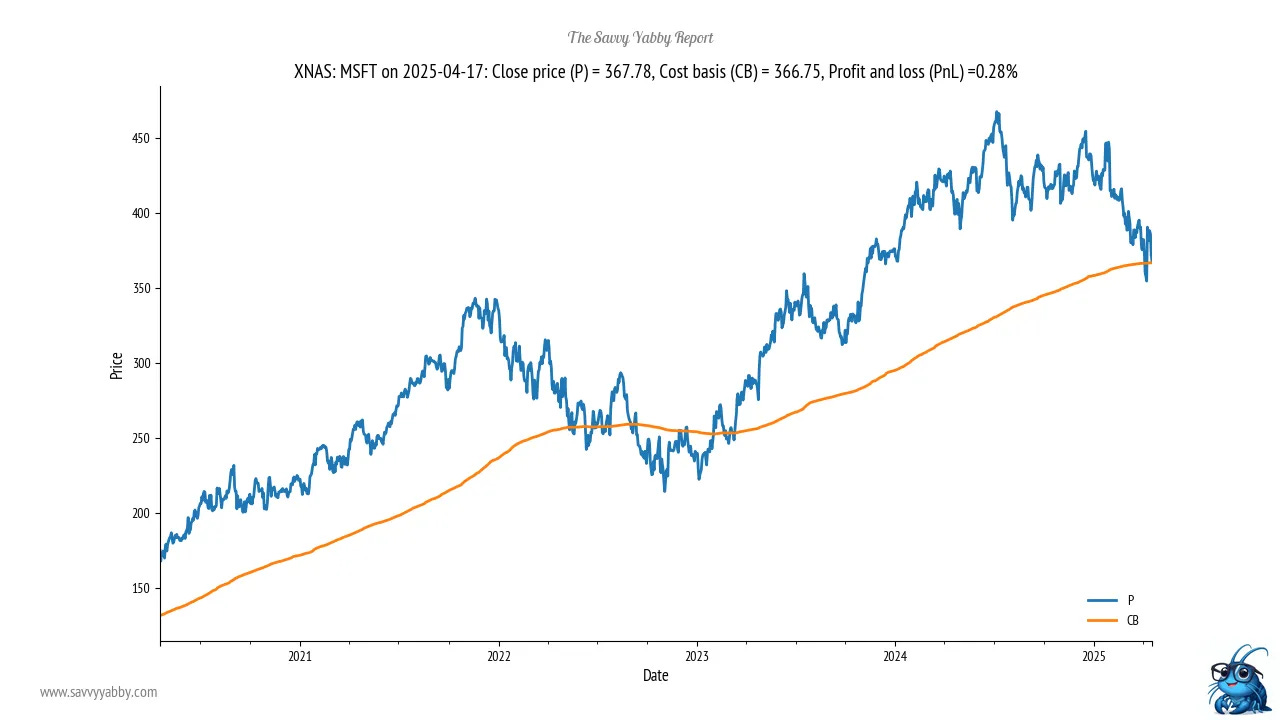

I am strictly an intellectual peashooter when lined up with this giant but felt the need to mathematize my financial failure in the form of an equation to estimate madness in crowds. This is the Savvy Yabby indicator for unrealized investor profit and loss.

I wrote about that in the article Enter the Yabby... Our Origin Story.

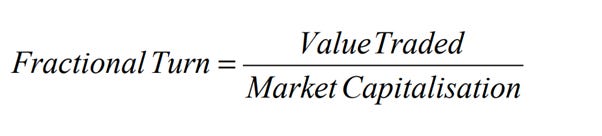

The formula has two parts.

The first part is related to the rate of turnover in a market.

This is an estimate of the percentage of the total company stock that was traded on any given day. It goes up and down each day. When a crowd goes mad, it will rise.

The second part is related to how turnover affects the average price of stock held.

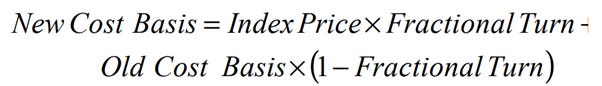

Those who do their own tax accounting know that this is called the cost basis for the stock you own. Few investors know this, but you can estimate the average cost basis of the total holdings in a given stock by applying the above formula.

The result is a moving average estimate of the average cost basis for a stock, or for the whole market. When the price is above cost basis, we have positive sentiment. When the price is below cost basis, we have negative sentiment.

Unlike Sir Isaac Newton I can calculate the misery or joy of investors.

Price above Cost Basis = Bull Market

Price below Cost Basis = Bear Market

That is all there is to the Savvy Yabby Indicator.

On the birthday of the Yabby I wrote: The Tao of the Savvy Yabby.

That piece addresses the “why” of knowing this measure of investor sentiment.

This is no “sure thing” guide to market direction, but it has helped me to make sense of what is going on within markets and between markets over time and cycles.

One of the best examples of such segmentation is sector dynamics.

You can have a stock market that is in a Bull condition, where some sectors are in a Bear Condition, and vice versa. It helps to know, for sure, which is which.

You could have the USA in a Bear market, and China in a Bull market.

Such conditions have arrived now, so we have our reason to be :-)

Onward, all Yabby kind! Let us develop and apply this to themes and sectors.

The Will Rogers Rule

Investment psychology is my private obsession.

It is the seemingly unquantifiable “It factor” that makes markets so tricky. There are times when the market seems to pay attention to fundamentals, and other times when it does not. There are times when investor sentiment is so positive that an entrepreneur can raise money for any foolish plan. There are other times when Mother Theresa herself could not raise a penny to feed a starving child.

This leads to perplexing homespun wisdom like this famous Will Rogers quote.

Obviously, we could use the Savvy Yabby Indicator to segment all markets according to whether the stocks went up, on average, for those who bought them.

This is a good idea, and I do that a lot, which is why I set up this newsletter.

However, since our subject is psychology, we should dig deeper. Anybody who has spent time in a market knows that winning groups of stocks acquire names.

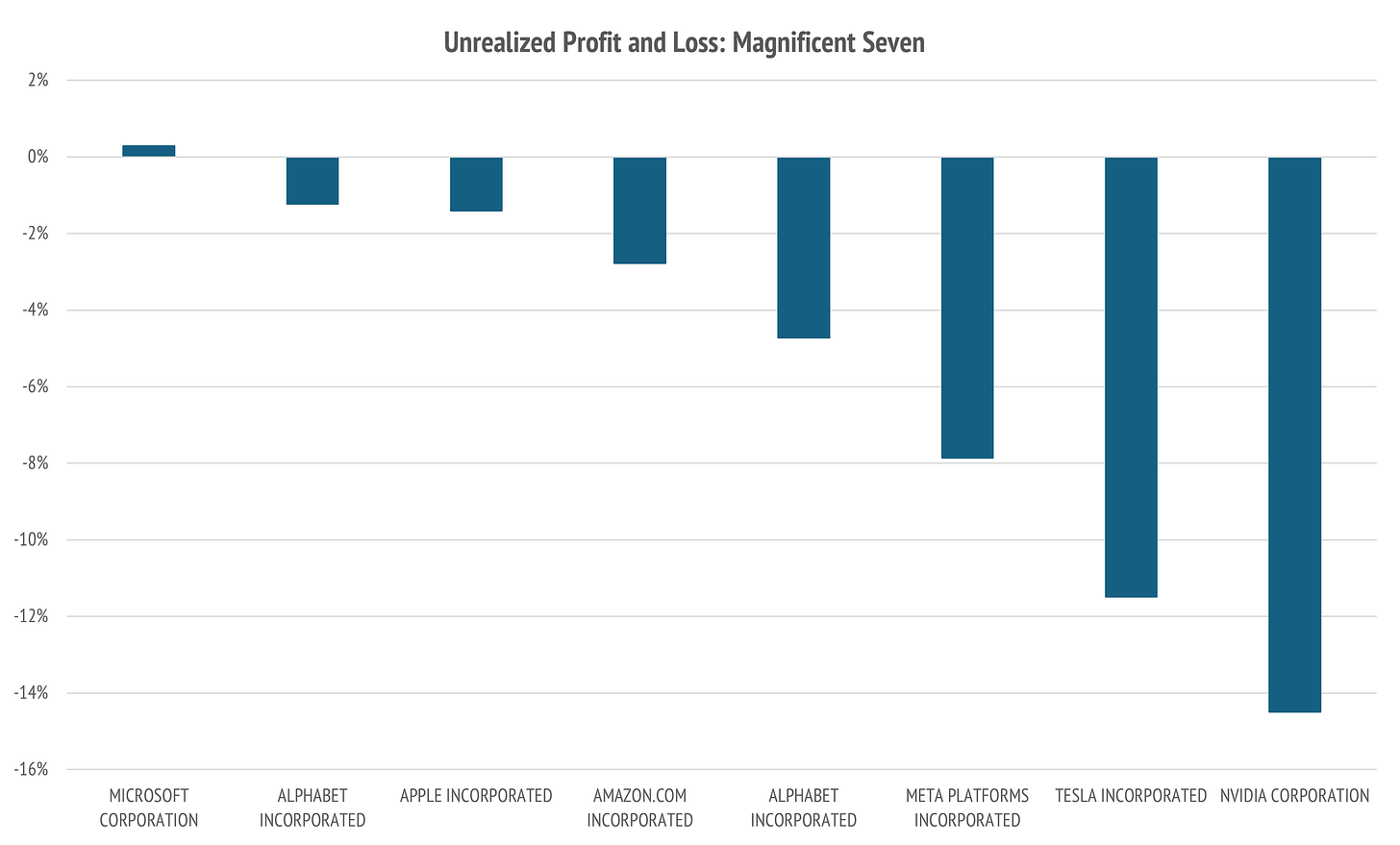

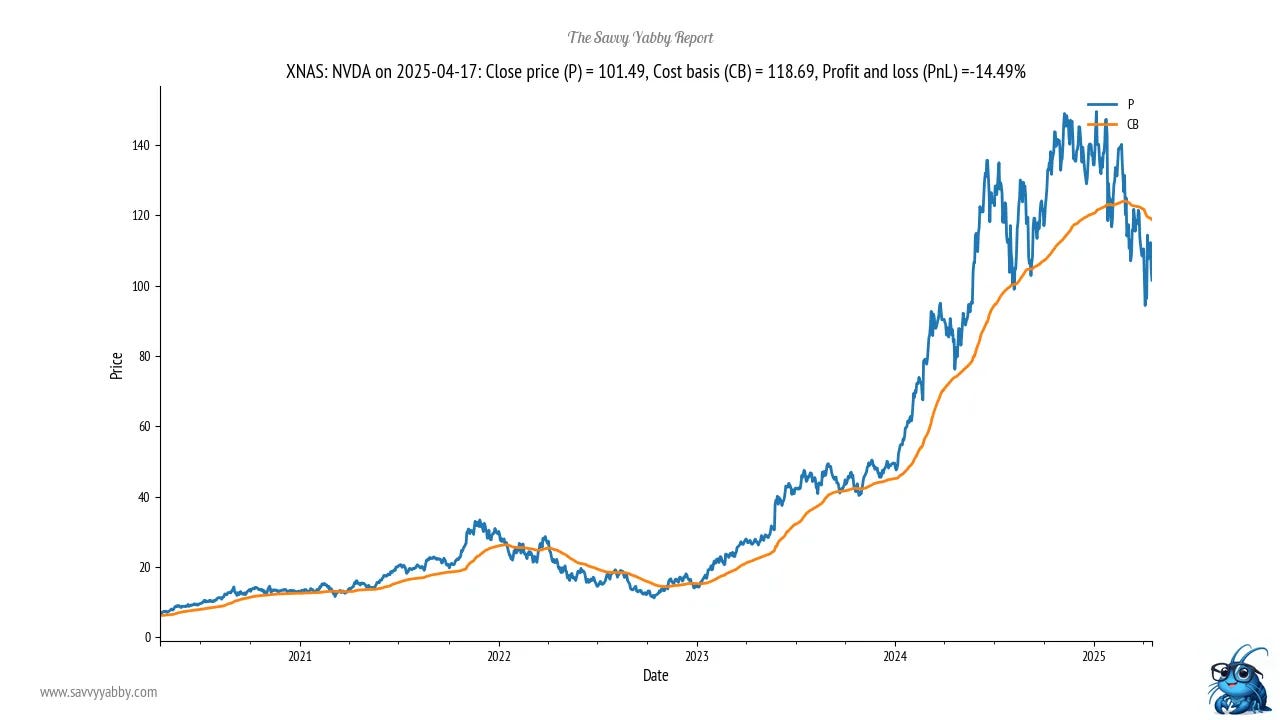

Recently, investor attention was dominated by the Magnificent Seven. In my previous post, The Global Investment Themescape, I showed how all but one of that group of widely held stocks is now in unrealized loss for its investor clientele. These investors have not followed the advice of Will Rogers. They bought the stock. It went down.

Whenever you have a stock in a durable Bull market the Will Rogers rule applies, and most investors will find that their stock went up over what they paid for it.

Once the conditions change, the sentiment can turn, like with Nvidia.

This is very simplistic, but the psychology of this effect is real.

Unrealized profits and losses are real, and they are a feature of the market.

The only thing I did was develop a methodology to estimate them.

Now I will introduce a new idea to further develop the Yabby.

The origin of investment themes

When markets switch conditions and some stocks enter a bear phase, others may be entering a bull phase. It is elementary that you should want to know which.

There are many ways to go about this, but the one I prefer is to recognize which new names for a group of stocks are becoming active in discussion.

Earlier I mentioned the Magnificent Seven. Way back in the 2000 Tech Boom everyone wanted to own the Four Horseman. Now they speak of the European Defense Seven, while folks like me coin new names, like the Causeway-Bay (China) Eight.

The concept to understand is that humans like categories or boxes.

Good stocks that caught attention demand new boxes.

What is it that defines a “good stock”?

The Will Rogers Rule defines good stocks.

When the average investor has made good money buying a particular stock it earns the right to be called a good stock. When many people make good money, buying the same stock over time, the brokers will notice and give it a name.

Trust me, I used to be a stockbroker, I did this for a living.

Stockbroking is marketing to earn commission for flow and the payment is your time on the phone to persuade you to buy. If every man and his dog made good money buying a group of stocks, then you have a theme worthy of a name.

How do you tell if a given investment trend is durable?

The short answer is you can never really tell.

However, you can lower the odds if the fundamental needs that the business group serves have their own story that explains the durable demand.

In simple terms, groups of good stocks, with a relatable demand story are more likely to perform over time. They will perform until the demand peters out.

Psychographic segmentation of markets

When trawling markets, what I look for is groups of stocks that are in unrealized profit, that are not yet widely owned, with a relatable story.

The story idea is simple: we segment stocks by the psychographic need they serve.

Since humans never change, this segmentation is a good guide to preference.

However, the dynamics of demand, and when and where that need arises, and for how long, will change over time. This is a principle not an inflexible rule.

Since this is me talking, and no other global investor I know of does this, I will take it slowly with an obvious and easily relatable example. I will then expand on this basis with other planetary excursions. This is a series to illustrate and educate.

It does not follow that you will get great value from this but do let me know either way in the comments. I have my own way to analyze markets that is 20+ years old. There have been many missteps on my personal journey, but I do aim to please.

The need for security in a time of conflict

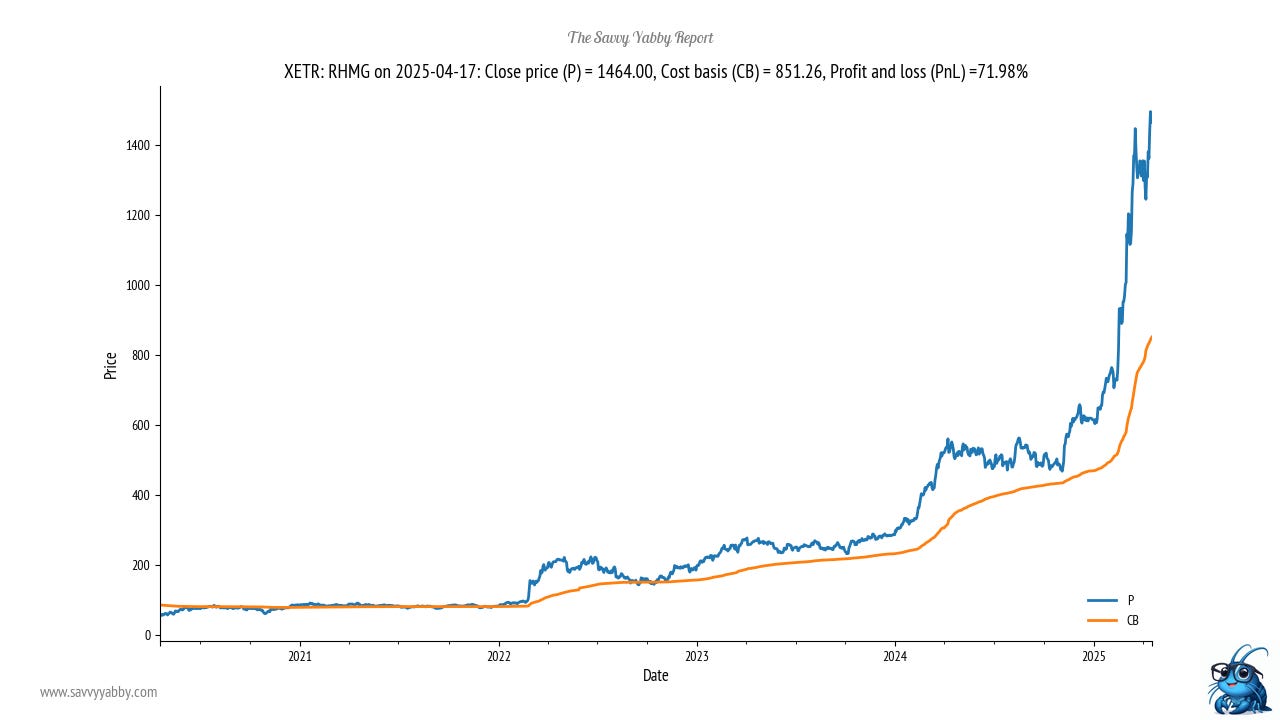

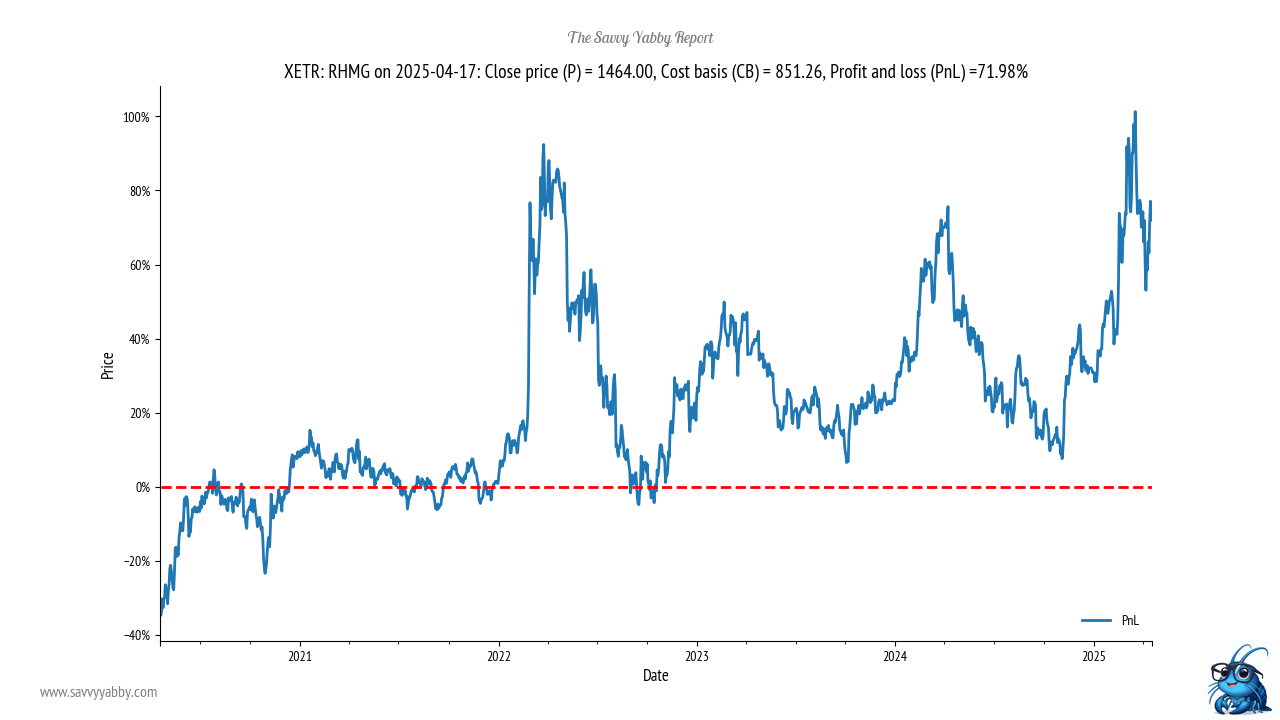

Let us look at an obvious example of Mars in the Ascendant. I am no merchant of the festival horoscope, but I do know that markets are nervous about war. There has been a War in Ukraine for three years now, and I owned Rheinmetall XETR: RHMG.

I do not own Rheinmetall right now, having sold a few weeks prior around the 1100 Euro mark. The investment began at 200 Euro, and I sold half around 600 Euro.

Here is the Will Rogers chart of investor profit and loss over time.

I had owned Rheinmetall before, and so I knew what it did when the war started. The main thing I knew was that it was one of the few producers of 155m artillery shells.

Russia has had a huge advantage over Ukraine in the possession and production of artillery to pound positions, and the ammunition to feed such guns.

I am not very keen on war, because my family history was shaped by it.

My grandad landed at Gallipoli in the first landing.

You will of course have heard of our doings here & I need hardly say that our first real experience of war was pretty severe we having to lie out on the ground open to rifle, machine guns, firing & shrapnel for the first couple of days till we could dig ourselves in. Reg Jones 19-May-1915

He survived but his two brothers that went to war did not return. He was a highly decorated soldier, but he never marched on ANZAC Day. It was too painful.

Since I had a pretty fair idea how horrifying constant artillery bombardment can be during trench warfare, I had no qualms buying Rheinmetall to supply Ukraine.

Thus far we have a single stock thematic.

Why did I sell, and will I be back?

There are two reasons to sell good stocks, to manage risk by reducing position size, and to position for a possible change in market conditions.

The psychographic need served by Rheinmetall is clear: defense and security.

However, this began with the pressing need of Ukraine and that war is winding down from sheer exhaustion on both sides, and the push for a negotiated solution.

What reignited this market, with a blowoff top on 17-Mar-25 was the German vote for an historic increase in defense spending, with funding from a relaxation of the former German sovereign debt limit - the so called Schuldenbremse, or debt brake.

What really drove this move was the sense of urgency in Europe to take more control of their own national security once President Donald J. Trump started sharing thought bubbles about annexing Canada, invading Greenland, and leaving NATO to Russia.

This dynamic creates a durable theme anchored by security and need.

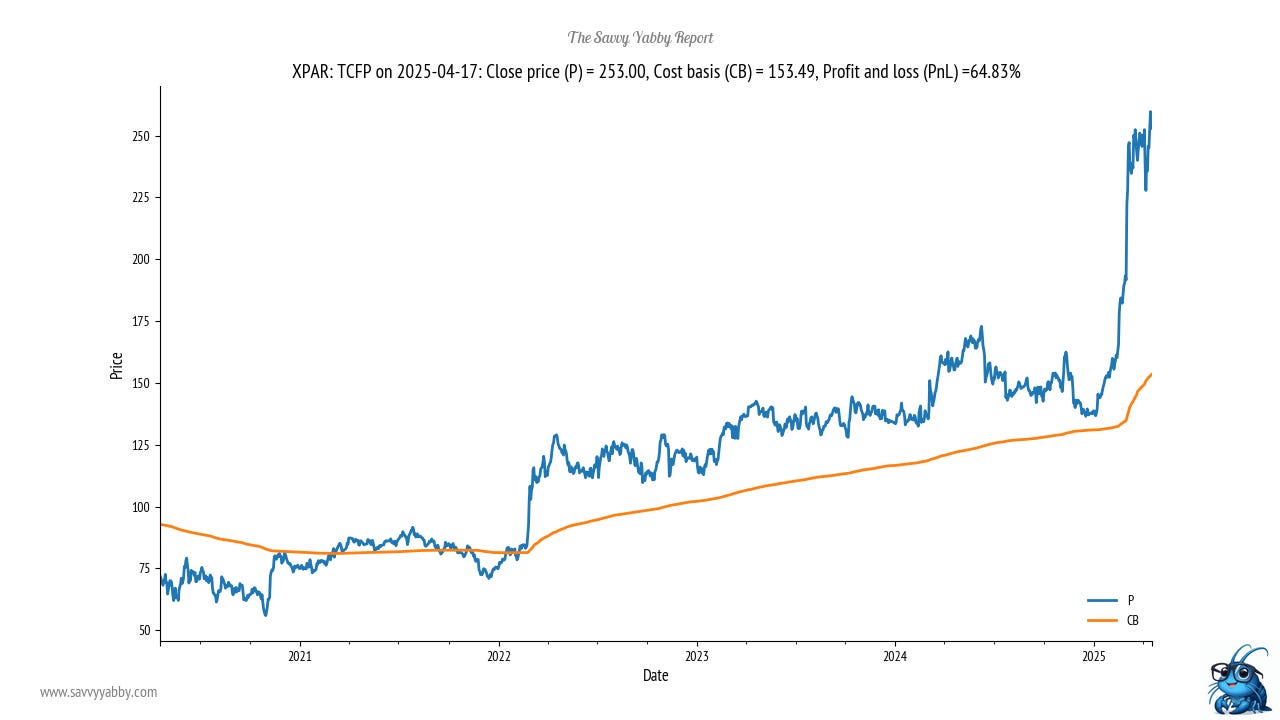

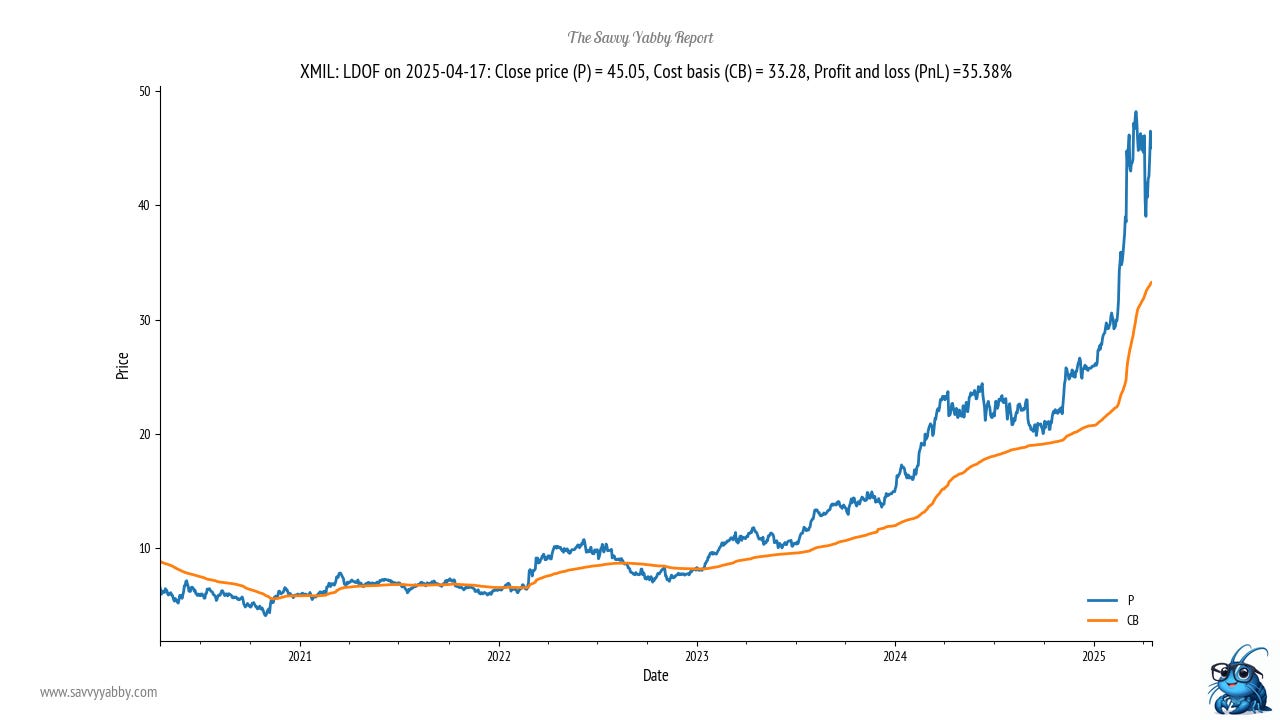

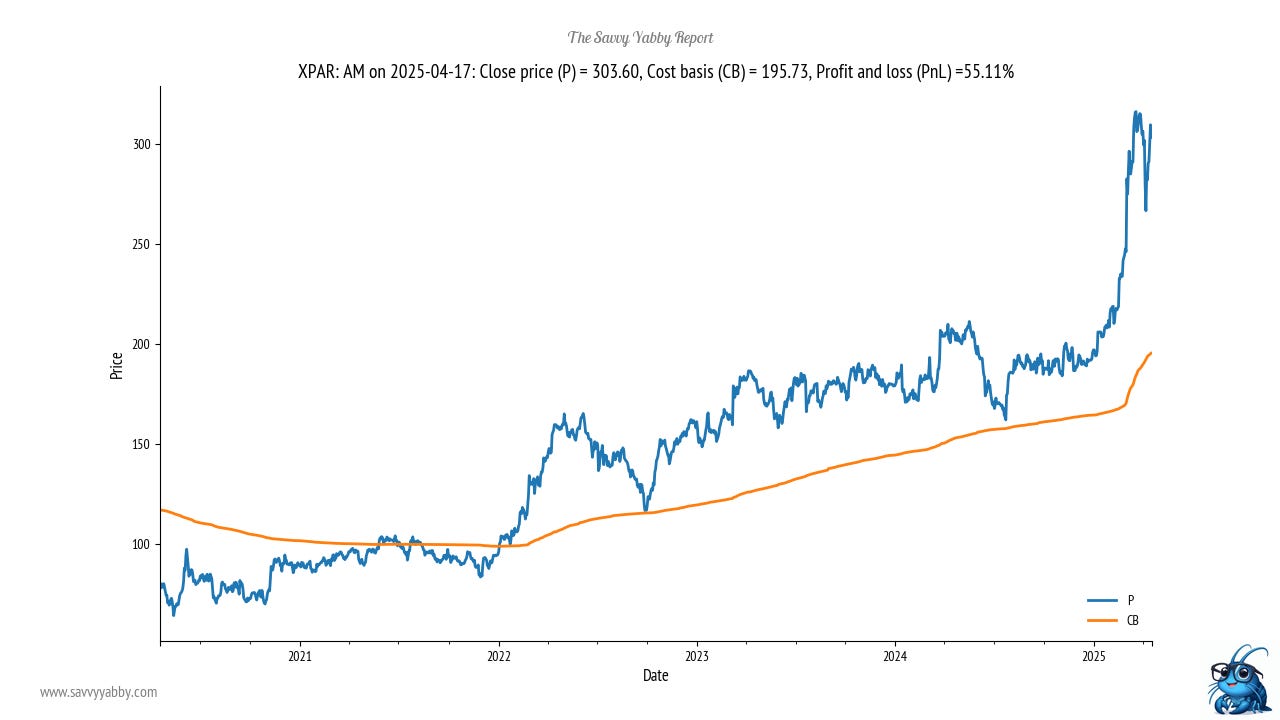

I played a few stocks that I already knew, namely Thales XPAR: TCFP, Dassault Aviation XPAR: AM and Leonardo XMIL: LDO, which make military equipment.

I took quick and modest profits on those once the Trump tariff lollapalooza emerged to shock the global investment community with its breadth and general kookiness.

Applying the highest tariff of all to African nation Lesotho, which produces knitwear for the American market is not going to make them buy F-35s. They are poor.

Clearly, the psychographic needs of Donald J. Trump are to tell everybody what to do, how much tribute to pay, and which body part to kiss.

Defense stocks are capital equipment plays, they are not likely defensive in a bear market, the changes to European spending are priced, and it will take years.

I maintain that this is a good situation for alert investors.

There will be all kinds of Trump induced whackiness in global markets. The challenge is to locate where the appropriate stress points lie to pick up exposure over time.

The global defense stock universe

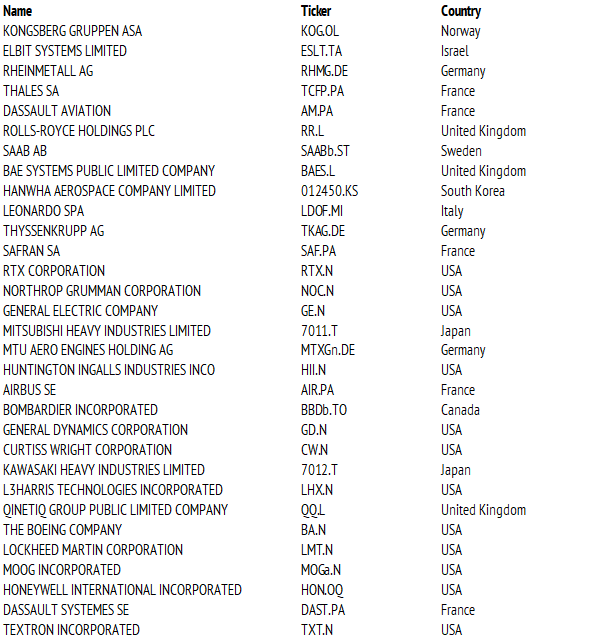

To start this process, we need to assemble a stock universe of targets.

Here is my large cap list.

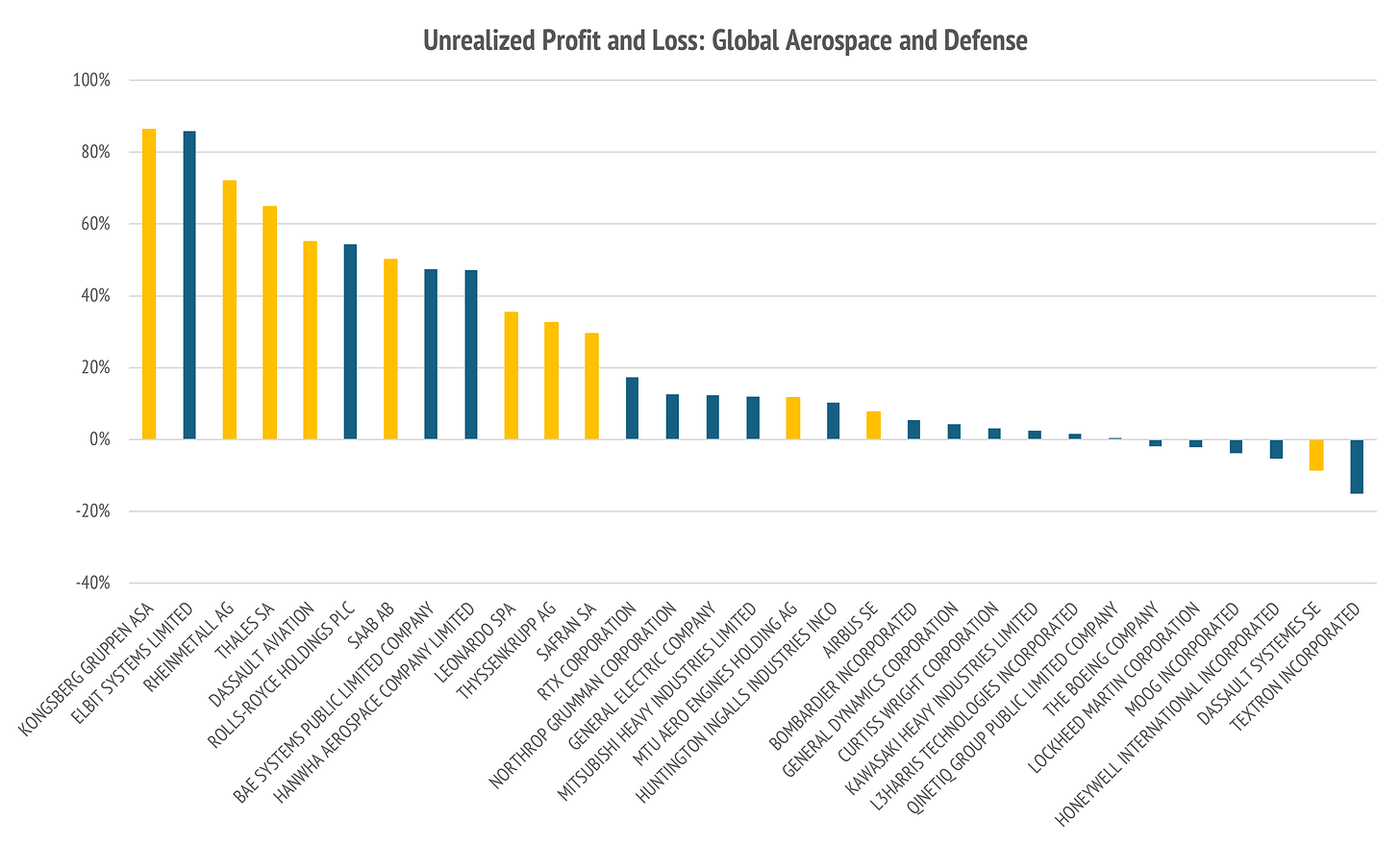

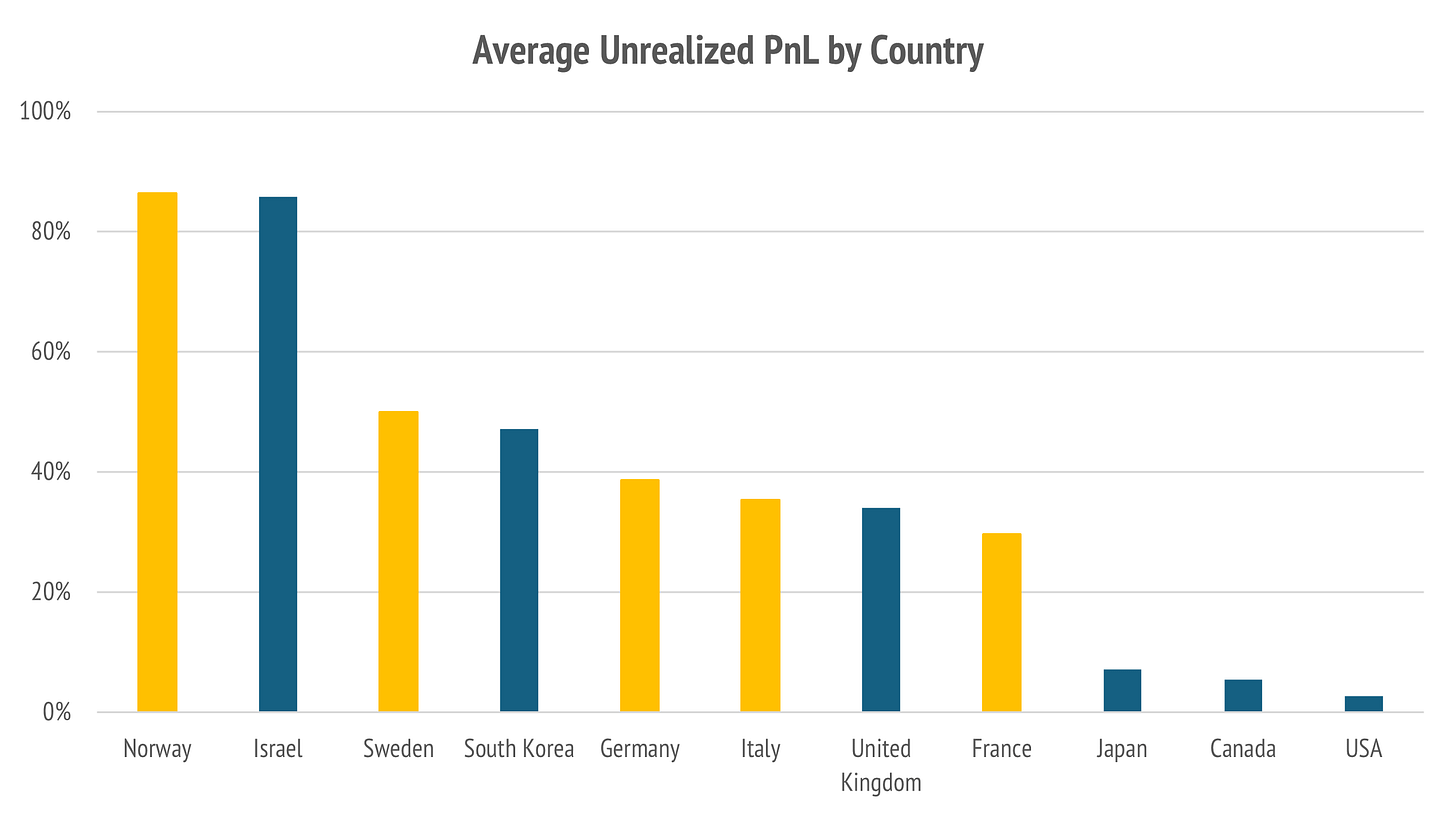

These are arranged in descending order of unrealized profit and loss.

Notice that the European stocks, colored in orange, are mostly positive.

The pattern is clearer when we average the profit and loss by country.

Israel is in a war, so that is no surprise, and South Korea is next to North Korea.

However, the USA talks a big defense talks and is nowhere. Canada is to the USA as South Korea is to North Korea, but it does not look that worried.

All the positive defense stock sentiment is in Europe

This fits with what we know on the ground.

Notice that Norway and Sweden are very positive because the Russian Bear regularly shows up for a friendly game of edge-of-airspace tag in a Tupolev Tu-95.

When you look at the sentiment picture through the lens of what we know about real world events, you can see two things right away:

This is a sensible durable psychographic need for defense and security

The bull market is still early and will likely have pullbacks

There are other things to note also.

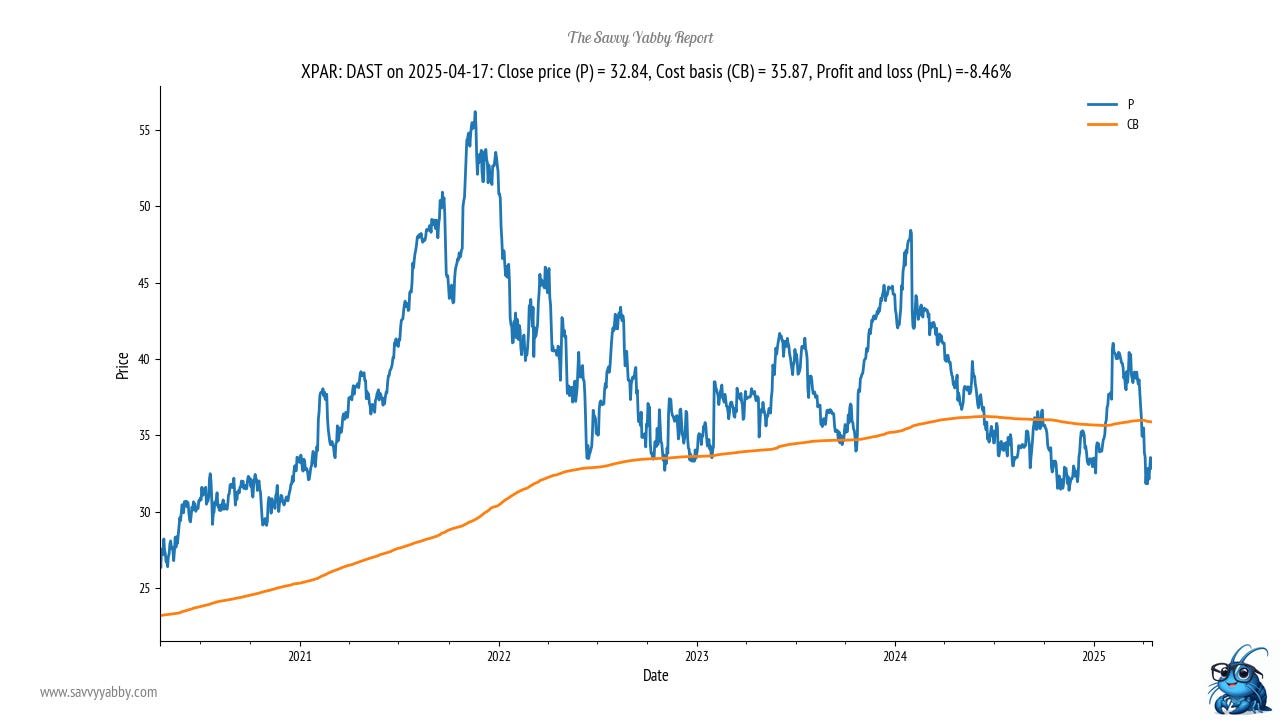

Look at Dassault Aviation XPAR: AM versus Dassault Systemes XPAR: DAST.

One has very positive sentiment while the other has barely moved!

Since I used to work in Defense R&D I can tell you that Dassault Systemes is very much a defense company. It produces CAD design software for Airbus.

If you are building out European defense, you are going to need design software.

In Trump World, if you are building out European defense you will NOT use any American sourced digital design software if you can possibly avoid it.

This is another example of changed psychology.

Purchase decisions, funding decisions, sourcing decisions all changed.

These decisions changed all at once due to Donald Trump.

They did not change in America, Japan, or Canada.

They have changed in Europe.

Finding the key levels

I said earlier that I sold out of European defense positions to await better entries.

Let us look at that decision through the cost basis lens.

Above I showed the group leader Rheinmetall. The average PnL is now 72% and the cost basis is sitting around 851 Euro. There was a one-day correction which knocked the intraday low down to 933 Euro. This is looking like the right target area to buy.

Look now at Thales XPAR: TCFP and note that the cost basis level is way down around the 153 Euro mark. The volumes have yet to really lift on this one. It may be a good entry now but be watchful for general conditions in global markets. The low of the intra-day panic of 7-Apr-25, the same day Rheinmetall fell, was 228 Euro.

Italian helicopter maker Leonardo XMIL: LDO has had a bit more turnover that lifted the cost basis more quickly to 33 Euro. The 7-Apr-25 low was 34 Euro. Good buying.

French aircraft maker Dassault Aviation XPAR: AM is more like Thales. The turnover has yet to really lift here. Cost basis sits around 196 Euro, and the 7-Apr-25 panic knocked it down to 257 Euro for a brief while. That territory looks good.

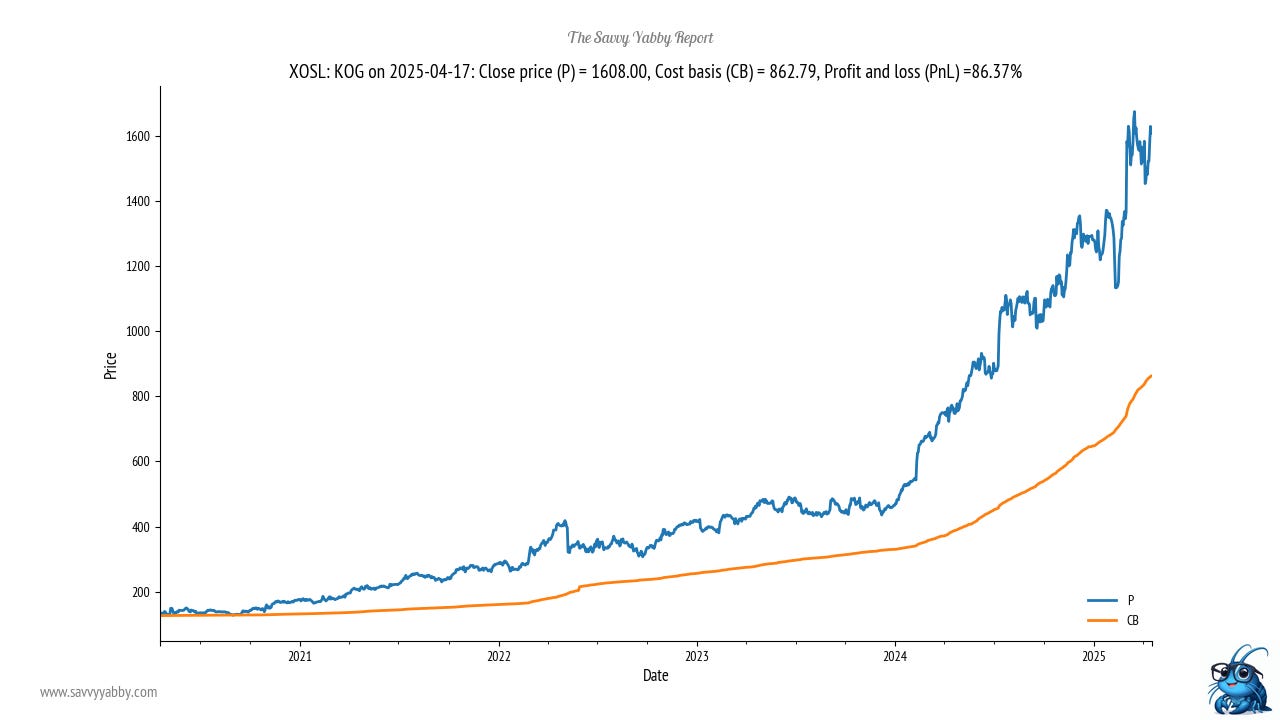

Norwegian weapons system supplier Kongsberg Gruppen XOSL: KOG is a gem. This looks good with a wide support below cost basis and no frenetic trading. It is a buy.

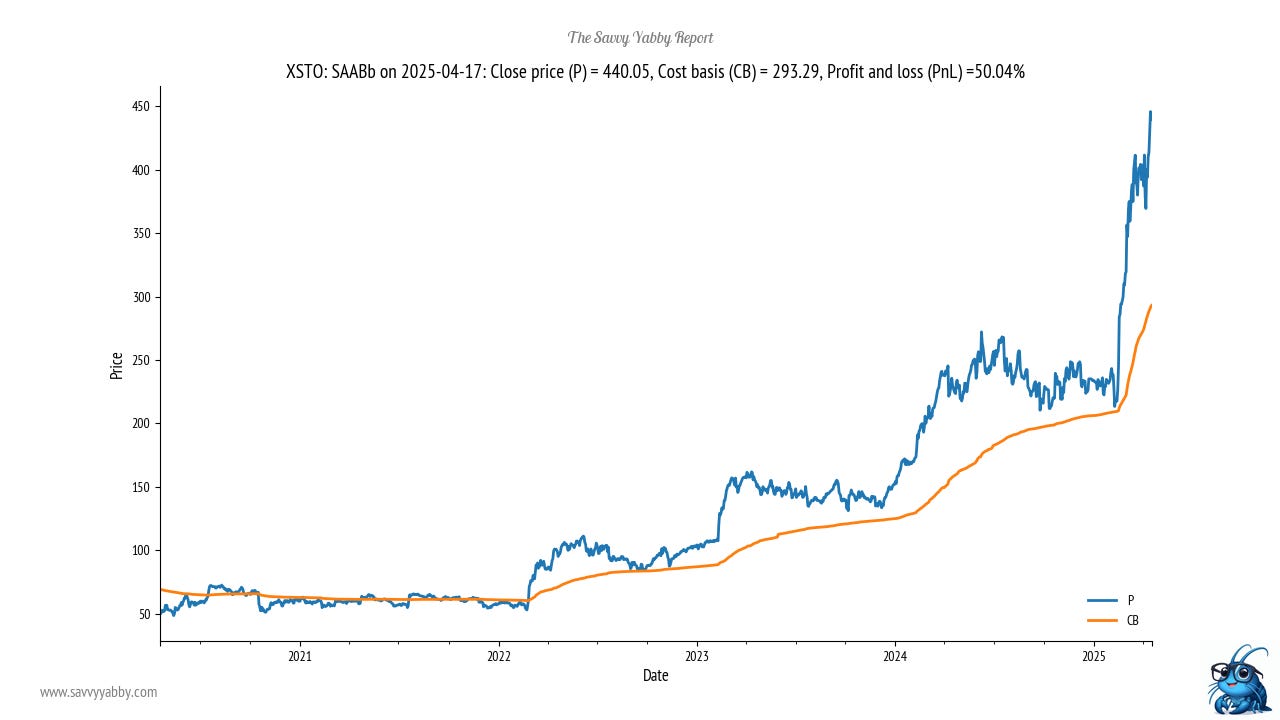

Saab XSTO: SAABb is not the car company. It makes fighter jets and submarines.

Notice that this stock is more step and go. Timing makes sense here. Look for a slow retreat on each rise as the wider market digests whatever news drove it upward.

Airliner maker Airbus XPAR: AIR has a large defense business, being a 37.5% owner of missile group MBDA, along with Leonardo at 25%, and BAE Systems at 37.5%. I think this group will be a major winner from the US-China trade war, depending on how Europe handles the coming negotiations. Airbus is not Boeing, and China likes that.

Finally, let us look at Dassault Systemes XPAR: DAST. There is no need to buy now, but I would watch the earnings reports on this one to see any pickup on defense orders.

Conclusion

This educational note covered the topical area of European Defense Stocks from the point of view of investor psychology, both the underlying psychographics of need, namely security in a time of conflict, and the hidden sentiment of unrealized PnL.

These tools need to be supplemented with active tracking of fundamentals.

I will talk about valuation in the next installment on Saturn.

This is the planet associated with melancholy, the metal lead, and pessimism.

I am naturally an optimist, so I will focus on the Saturnine virtue of discipline.

The greatest virtue you can show in a time of turmoil is discipline.

We are going to illustrate with the global bull market in insurance stocks, and the global bull market in the metal gold, the barbarous relic now bought as President Donald J. Trump, what will he do next, defense against crazy people insurance!

Good luck and happy investing!

Yabby tired now.

Must eat Easter treats.

Thanks for another insightful and educational report. The Savvy Yabby has introduced a fascinating new perspective to my investing universe.

I have been selling down some of my portfolio holdings into current strength taking your view that this rally is a "gift".

However, there is some cold water sloshing around my feet after seeing research (from Shaw and Partners) showing that over the last 38 times the VIX has been above 60 (as it was on April 7th), the market has been positive 100% of the time in the following 12 months, with returns, on average, greater than 38%. (range 14.7% up to 79.2%).

Is the water still warm where you are?

David