Opportunity in the Iron Ore Rout

Australian Iron & Steel stocks tend to get hit hard regardless of their exposure to the iron ore price. However, some of them are steel producers not miners.

Only a week ago we posted on our top ten AUKUS opportunities.

One of them was an Australian steel producer.

In between then and now, the Australian market had a good panic about weaker steel demand in China, due to slower housing starts.

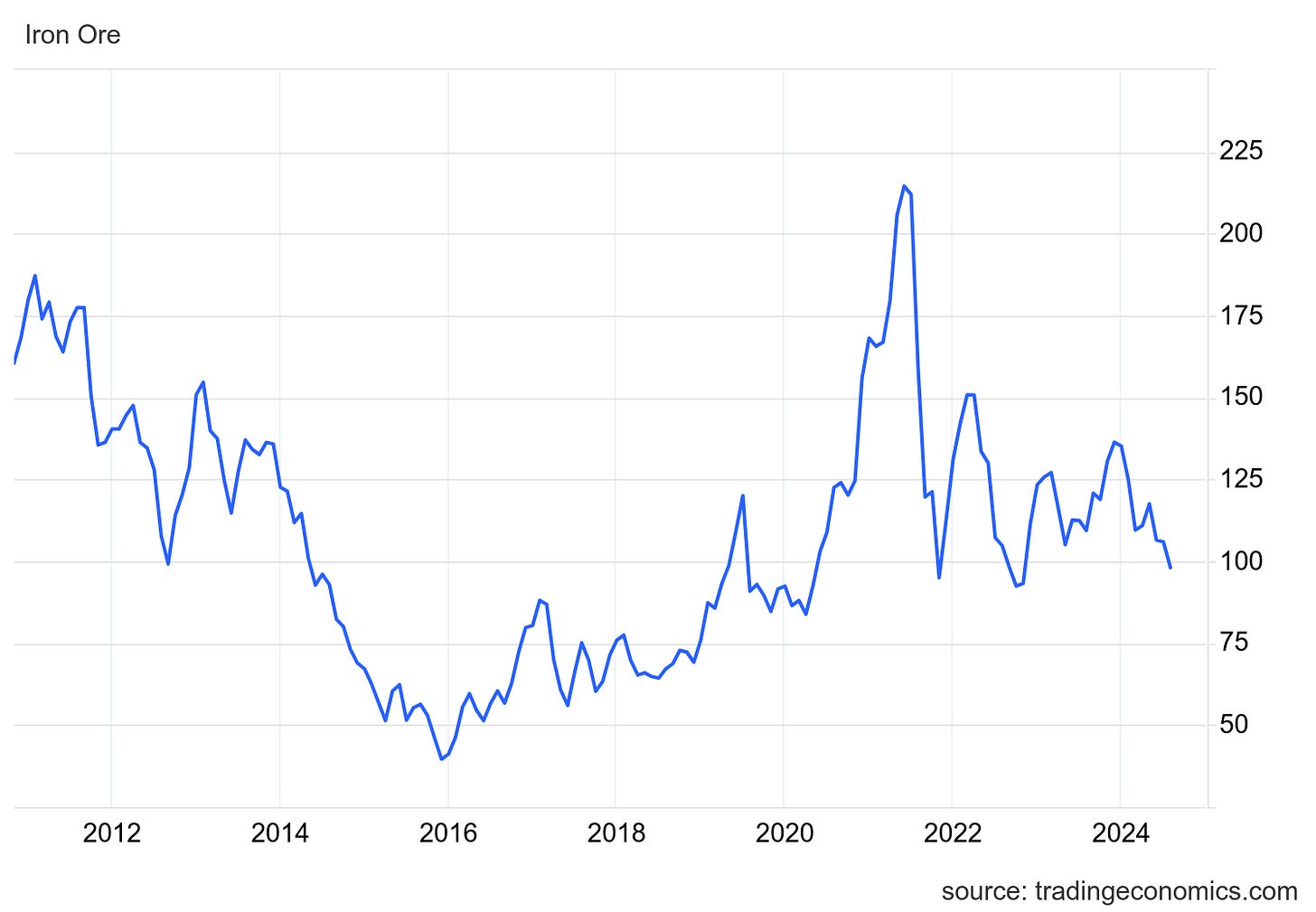

The is not unreasonable, as China is the world’s largest steel market. This has driven the iron ore price back below USD $100/tonne as you can verify here.

When China sneezes Pilbara iron ore stocks catch a cold.

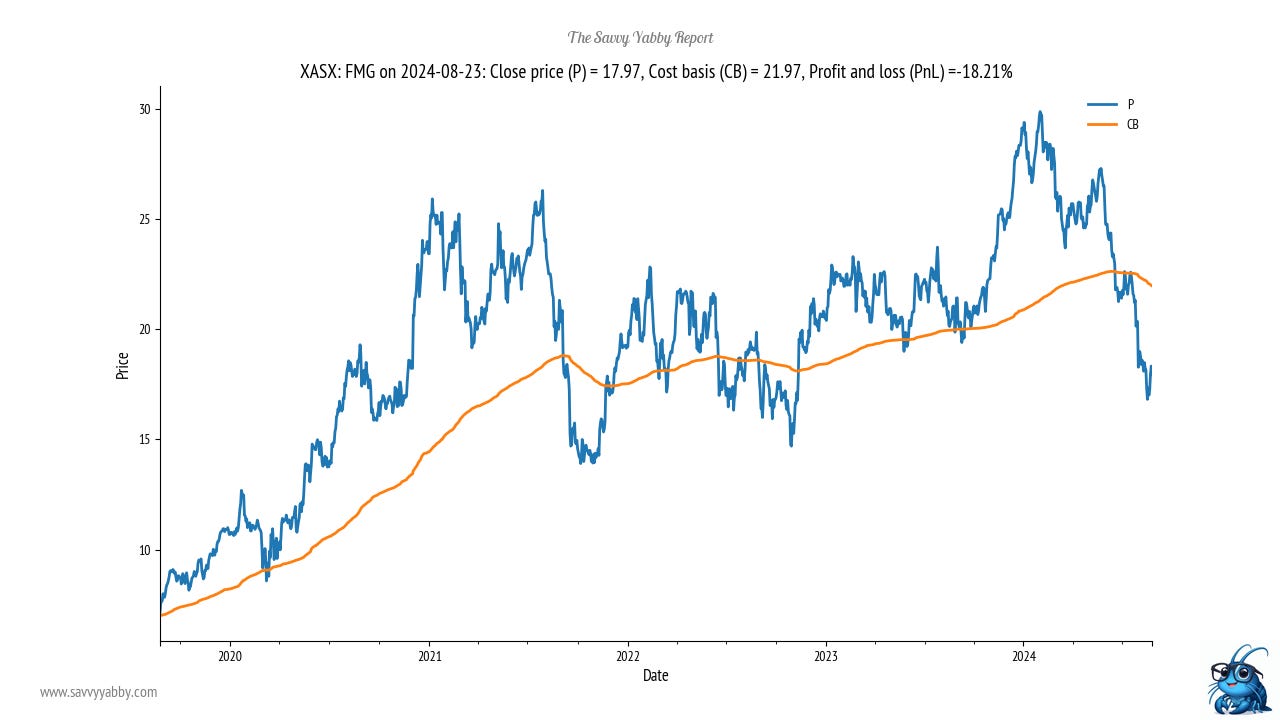

Fortescue Metals Group XASX: FMG was hit hard.

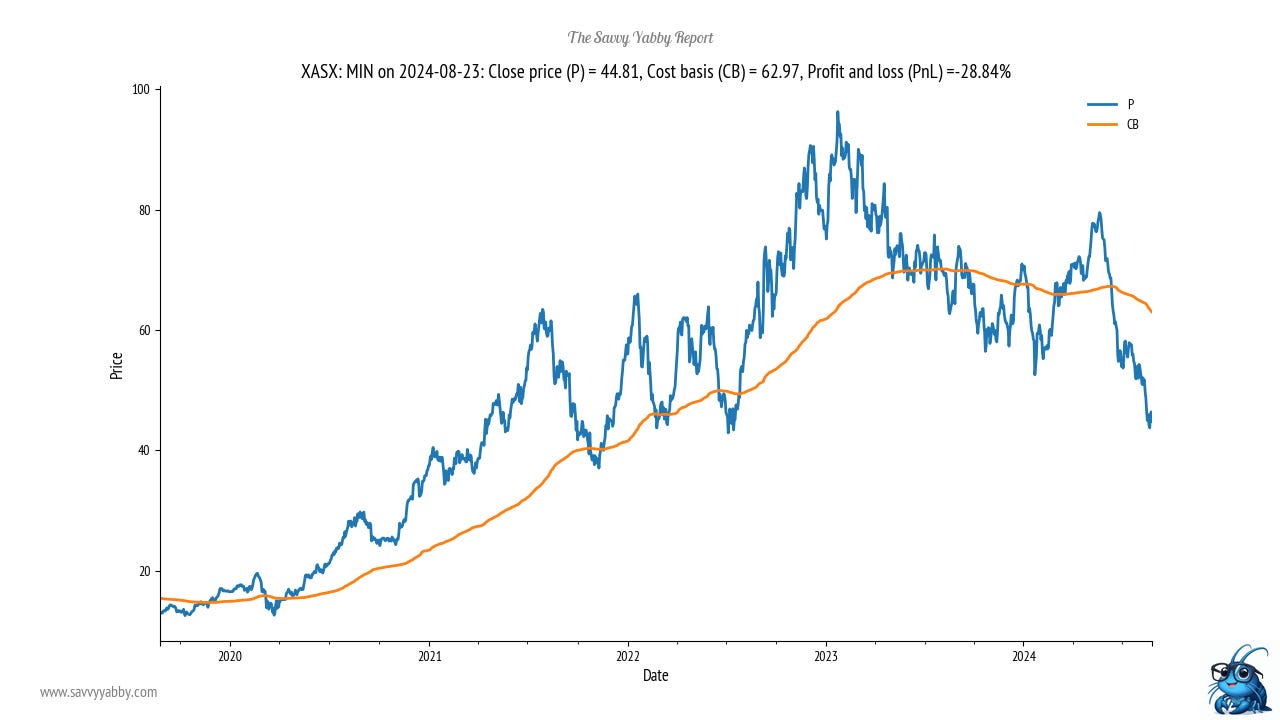

Mineral Resources XASX: MIN has the drag of weaker lithium prices plus iron ore.

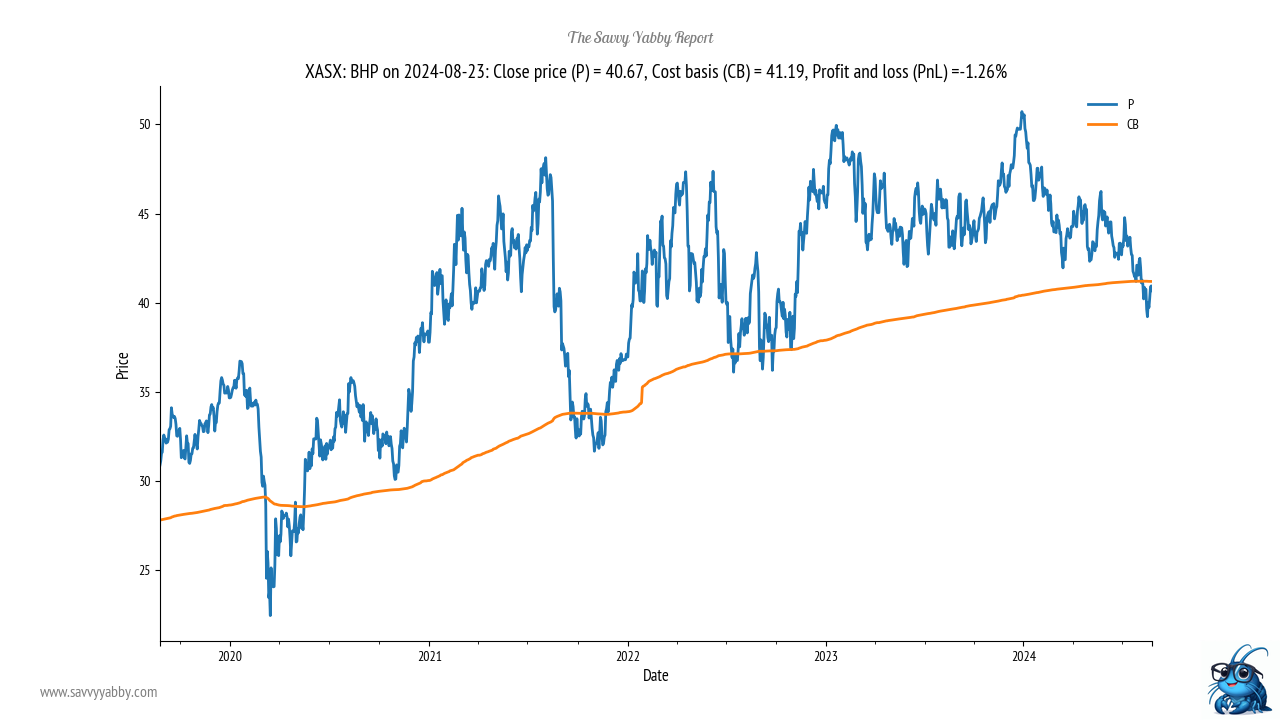

BHP Group XASX: BHP is more diversified, but still soft. They will report on Monday 26th August. Clearly, the iron ore outlook will be key for the market.

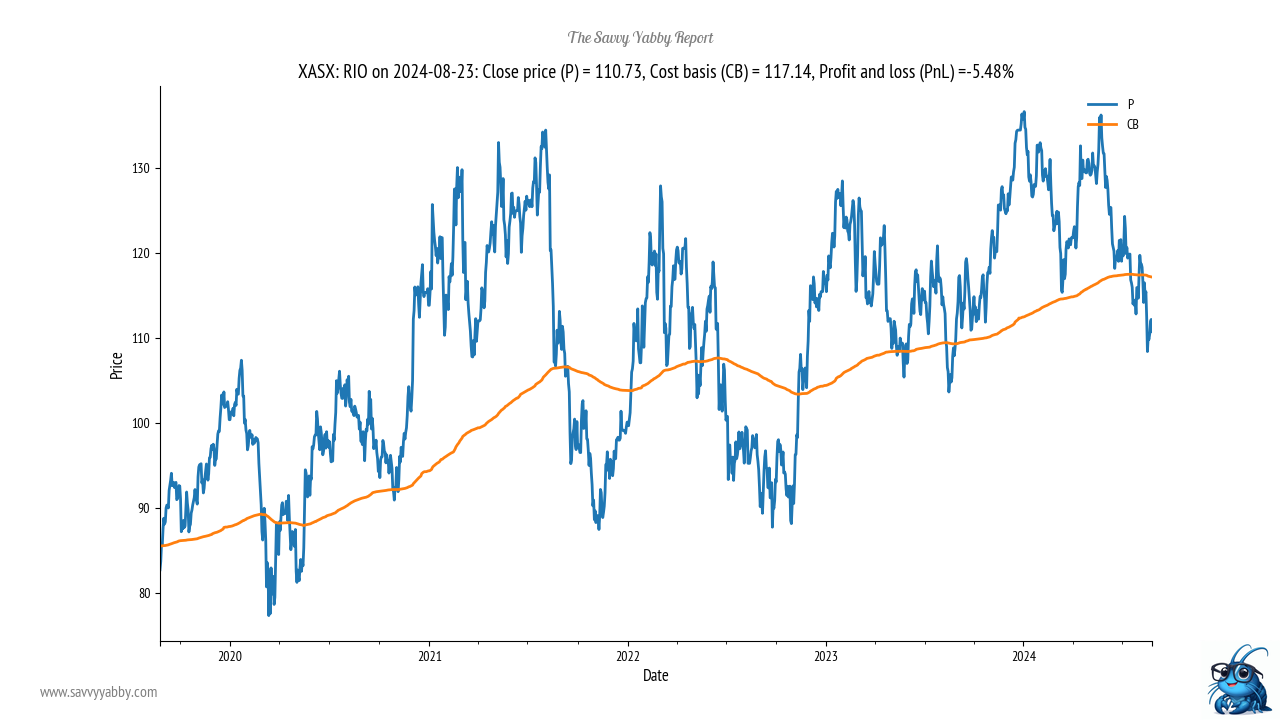

Rio Tinto XASX: RIO reported back on 31-Jul-24 and is also soft.

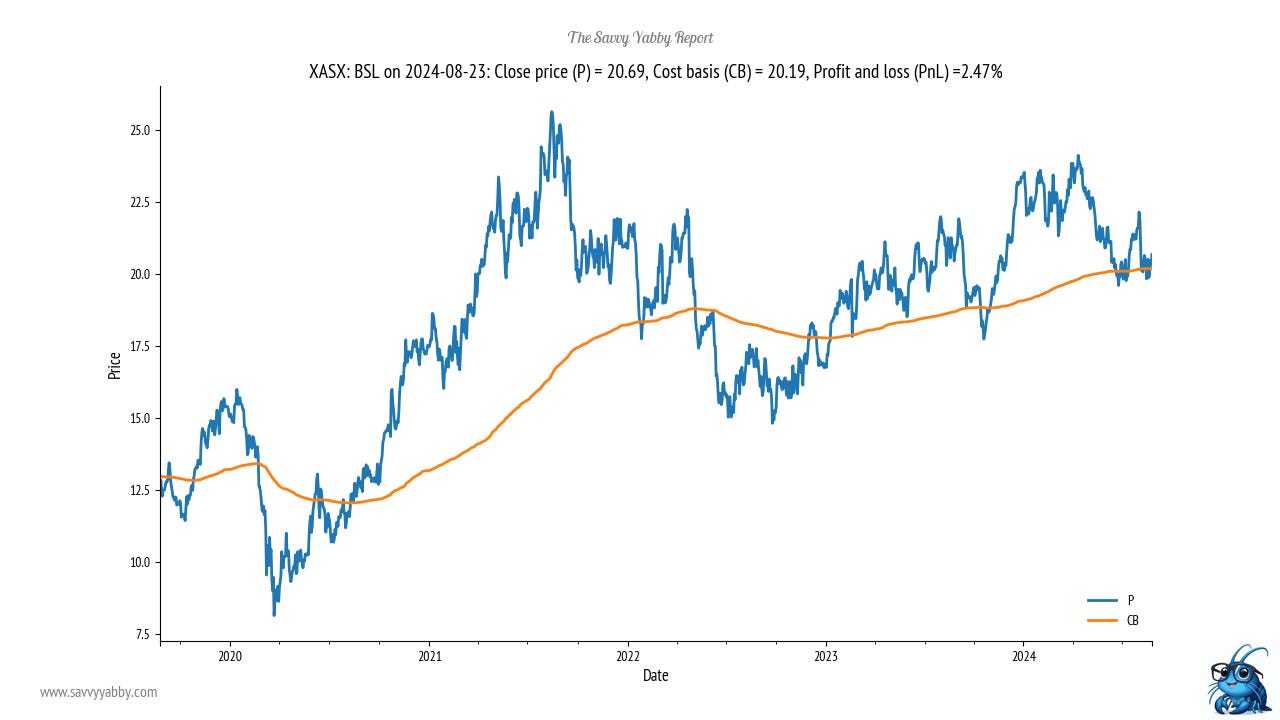

Among stocks over AUD $5B capitalization that only leaves XASX: BSL Bluescope Steel.

There you have it, so far so sensible.

These are weaker times for the global steel market, and so we should be prepared for a general bear market. How bad that may get depends a lot on the outlook.

The coming BHP Group result will be widely watched.

So where is the opportunity among the wreckage?

Keep reading with a 7-day free trial

Subscribe to The Savvy Yabby Report to keep reading this post and get 7 days of free access to the full post archives.