The Naughty vs. Nice China A-Share List

These days folks in Washington D.C. have decided to do some stock-picking. Using their input, we compile a Naughty vs. Nice list of China A-Shares for 2025.

People say active management and stock-picking are dead.

However, this memo was never received in Washington D.C. where some folks, across a range of government departments, have started doing stock picking.

There may be some investment alpha here, but we are unsure of the sign.

The alpha could be positive or negative, so it pays to run an experiment.

This does not have to be a fair experiment, but it should be educational and fun!

With this goal in mind, I will kick off the new year with my Naughty vs. Nice list.

This involves me picking eight stocks each from the Shanghai CSI 300 according to whether I think their prospects are good and dividing these in two groups.

The Naughty group are stocks I think will do well but the USA has sanctioned.

The Nice group are stocks I think will do well but are not (yet) sanctioned.

It is hard to predict what Washington D.C. does next, so the list will only change once every year. I will assume that Naughty stocks stay naughty, and the Nice stay nice.

To keep everything right-side up, and positive, we will choose eight stocks on each list.

That gives each group a fair chance to get lucky.

When X-mas comes around in 2025, we can save Santa the trouble!

You, me, everybody, will know if it paid to be naughty or nice in the coming year.

It is the Year of the Snake, so do not be surprised by a lucky upset.

The 2025 Naughty vs. Nice List

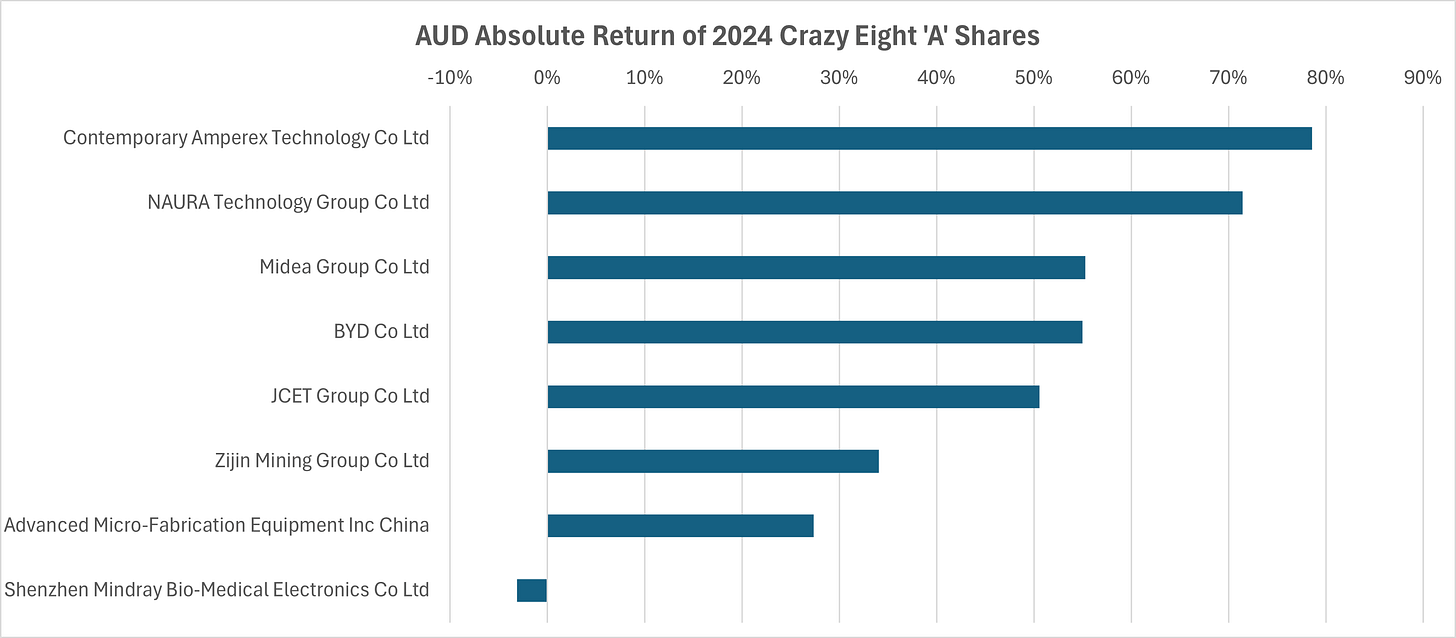

For those who do not know, last year I did a fun exercise picking eight China A-Shares to do well in 2024, at a time when the popular press was calling a China collapse.

The Crazy Eight A-Shares, as I called them, did okay.

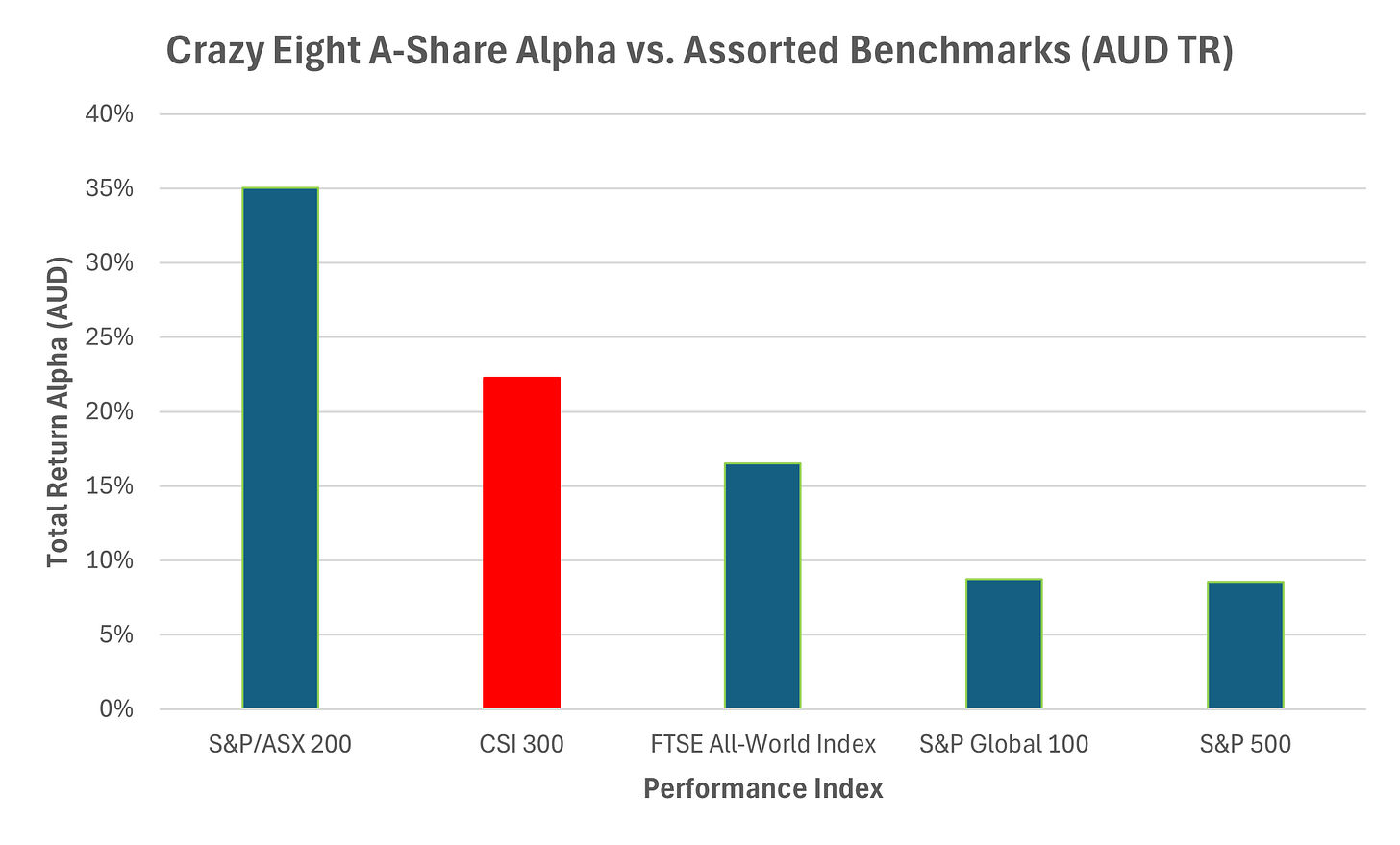

The performance of the Crazy Eight A-Shares was great versus a slew of benchmarks.

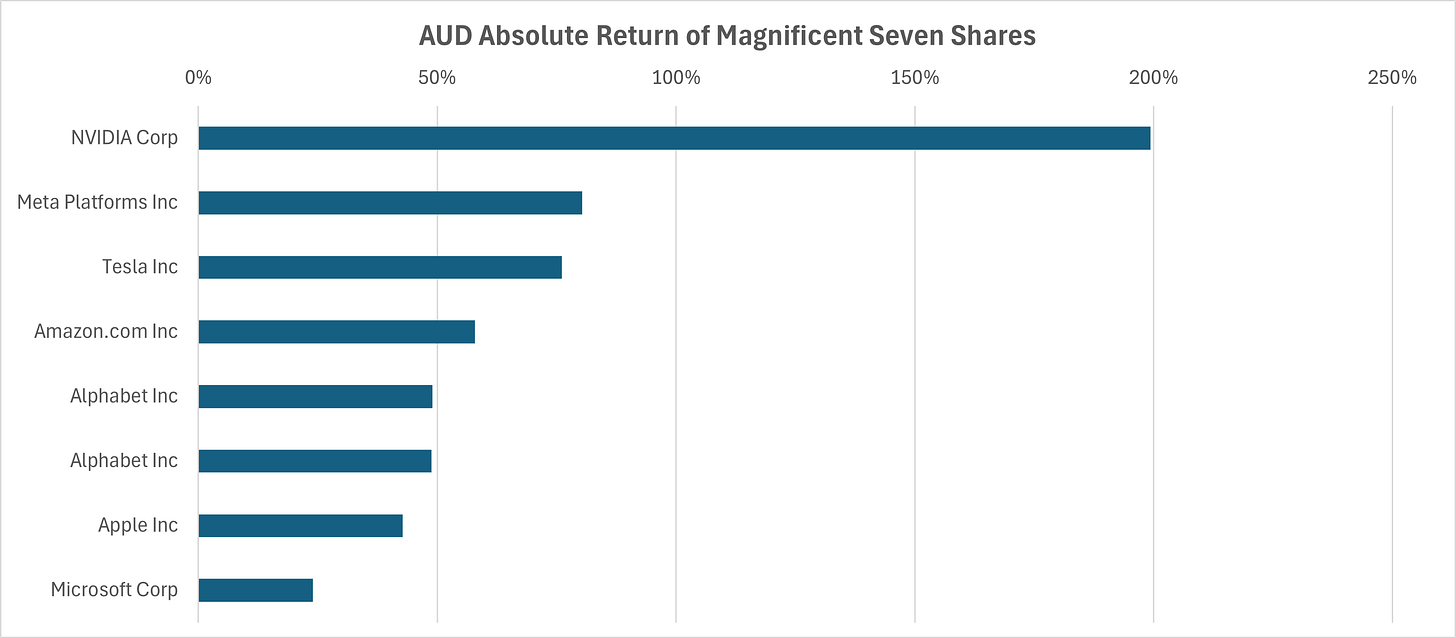

However, the Magnificent Seven did better than the Crazy Eight, which is fine.

This is China and it was about to collapse.

For some reason, China did not collapse, so I think the Crazy Eight were just lucky. While folks were mainly focused on the Magnificent Seven, they did okay.

It must be the number eight, so I do plan on sticking to that!

However, you will note that, in the age of ESG, this was a totally immoral exercise.

The trouble is that I paid scant attention to U.S. Sanctions.

With Washington D.C. as our moral godfather, and spiritual guide, we can now fix that!

When I picked that Crazy Eight list, in Dec-2023, Naura Technology was not under any U.S. sanctions. Starting in the middle Dec-2024 it was sanctioned.

In order to add back a measure of public decorum, and morality, we should designate all candidate stocks as naughty, or nice, according to whether they are sanctioned.

This way we can pick which stocks have good outlooks and find out the value of being moral in this world of ours. We can determine the alpha of being naughty vs. nice!

Sanctions Lollapalooza

Sanctions have become the American way to say, I love you!

There are an awful lot of US sanctions, and they are growing like topsy.

The legality of sanctions used to revolve around the United Nations, the supra national body, membership of which requires agreement to its principles.

Under its charter, the UN can legally impose sanctions on different nations.

There is a reciprocity at work. Nation states, which are the only entities which can be members of the United Nations, can vote on resolutions, including sanctions. These happen under the auspices of the United Nations Security Council, Article 41.

US sanctions are unilateral measures that it imposes outside the UN charter.

The legal basis for these is moot. The USA can make laws for its own people and firms but cannot make extraterritorial laws, at law, for other nations and peoples.

However, coercion of other states can make US unilateral edicts effective.

The USA started down this path when it became frustrated by the United Nations due process involving resolutions put before the UN Security Council.

Since the five permanent members of that body, the USA, France, the UK, Russia and China, all hold a veto on any UN Security Council resolution it is impossible for the United States to get any sanctions endorsed that Russia and/or China object to.

The USA is the good guy and anybody who is sanctioned is a bad guy.

That is by definition, and there is no need to bother with any due process nonsense.

This is a rules-based-order, don’t you know.

The USA makes the rules, and they are right, because it made them.

Where it is possible to ignore these arbitrary rules the Rest of the World does so.

However, Americans, and American legal entities are subject to the full force of US law.

Sanctions are US Law, so heaven help any US entity which violates them.

In this world, today, that means American citizens must pay attention.

If an American were foolish enough to buy the wrong stock, jail may beckon.

If you are an American citizen, you may want to review this document.

The penalties are listed under Sec 586E Penalties for Violation of Embargo, p. 52.

I could be threatened, and put on a US bad person list, but I am not a resident alien, I am not breaking US law. This fact is also moot. I have no desire to go on a list of bad people maintained by the one great and true source of justice. The USA!

Sanctions work because they make life next to impossible for the sanctioned.

This is unless you are Russia and China, who just shrug, and move on.

Chinese citizens can buy Chinese listed stocks that are sanctioned by the USA.

They do. Perhaps they figured out that what the companies do may be good for China!

Of course, being subject to sanctions can have a deleterious effect on business.

However, if you are any one of the sanctioned Chinese telephone companies you are not going to stop providing essential communication services to China.

You are going to shrug, move on, and do business with whomever will do business.

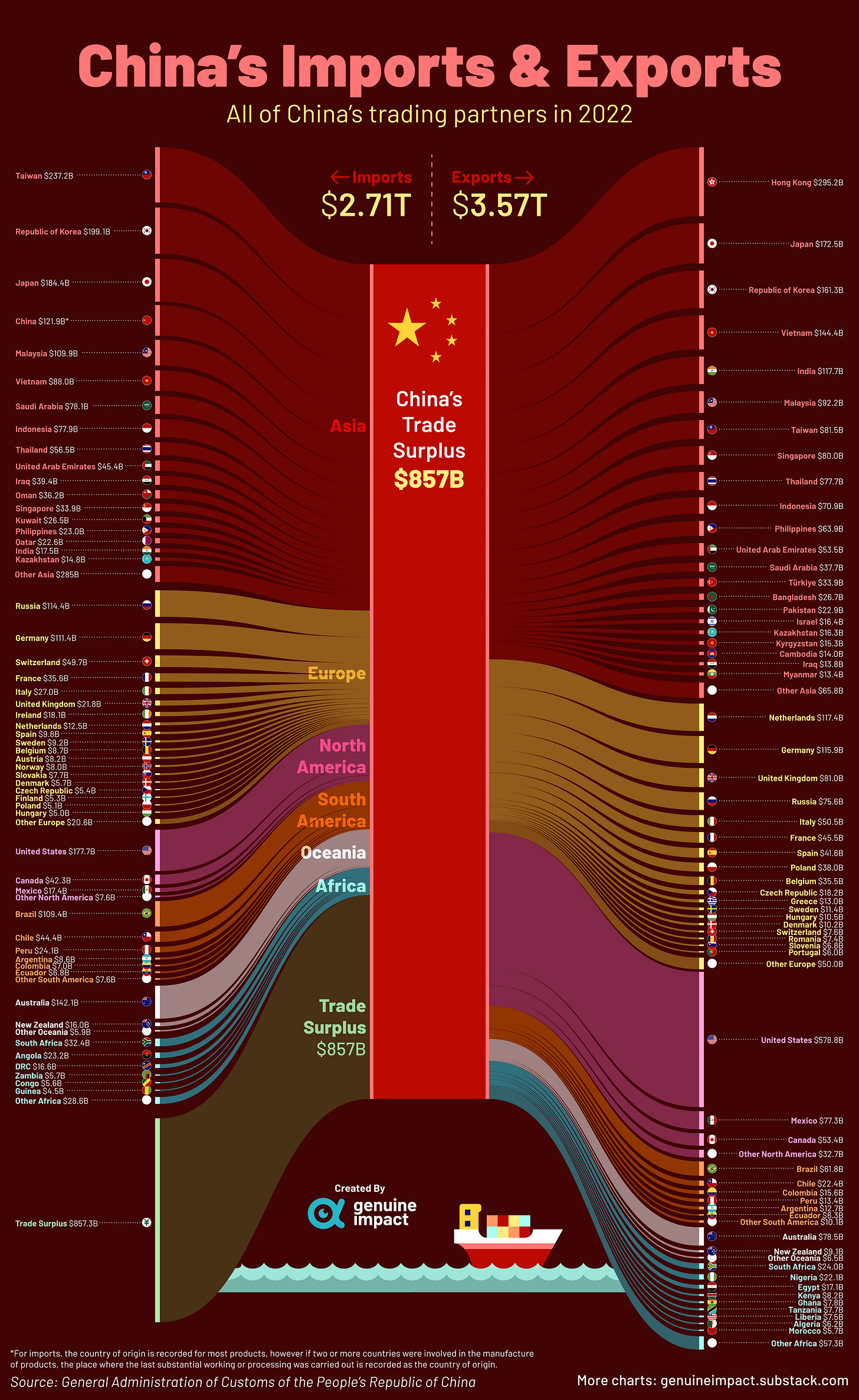

China does a lot of business the world over.

It can be frustrating to Americans that China has a trade surplus with them, and with the Rest of the World (RoW), in aggregate. However, many nations in Asia have trade surpluses with China. In the year 2022, the biggest import sources were Taiwan, the Republic of South Korea, and Japan. All had a China trade surplus!

The USA does not have a surplus, but does, or did, sell airplanes, semiconductors and other items to China. They are doing less now, which makes the trade deficit harder for the USA to close. Leaning on other nations to stop trade with China is definitely popular in the USA, and with the senior folks in the governments of allied nations.

However, it is becoming unpopular with the citizenry of allied nations.

It is said that the business of America is business.

Now the business of America seems to be stopping global trade and business.

This is not a good way to stay popular with anybody who does business.

That is most of Planet Earth. At some point, frustration turns to anger.

Once we reach that point, US Hegemony is Melba Toast.

The exercise of effective soft power requires some degree of intelligence.

The Hoover Institution wrote Why Economic Sanctions Don’t Work in 1998.

They still do not work.

Keep reading with a 7-day free trial

Subscribe to The Savvy Yabby Report to keep reading this post and get 7 days of free access to the full post archives.