Unboxing our KISS portfolio: IOZ+IOO

In the last stack, I mentioned a few options for ASX-focused investors to build their core equity portfolio using ETF product. Here we unbox the actual holdings.

The more experienced I get in global investment the simpler I like things to be.

"Life's too short to stuff a mushroom." - Shirley Conran

The Keep it Simple Stupid (KISS) principle applies to wealth management, as well as it does to the U.S. Navy sailors who chanted this risk management mantra in the 1960s.

In our last stack, I introduced some simple ASX listed ETF combinations that provide an inexpensive core global equity portfolio solution for self-directed investors.

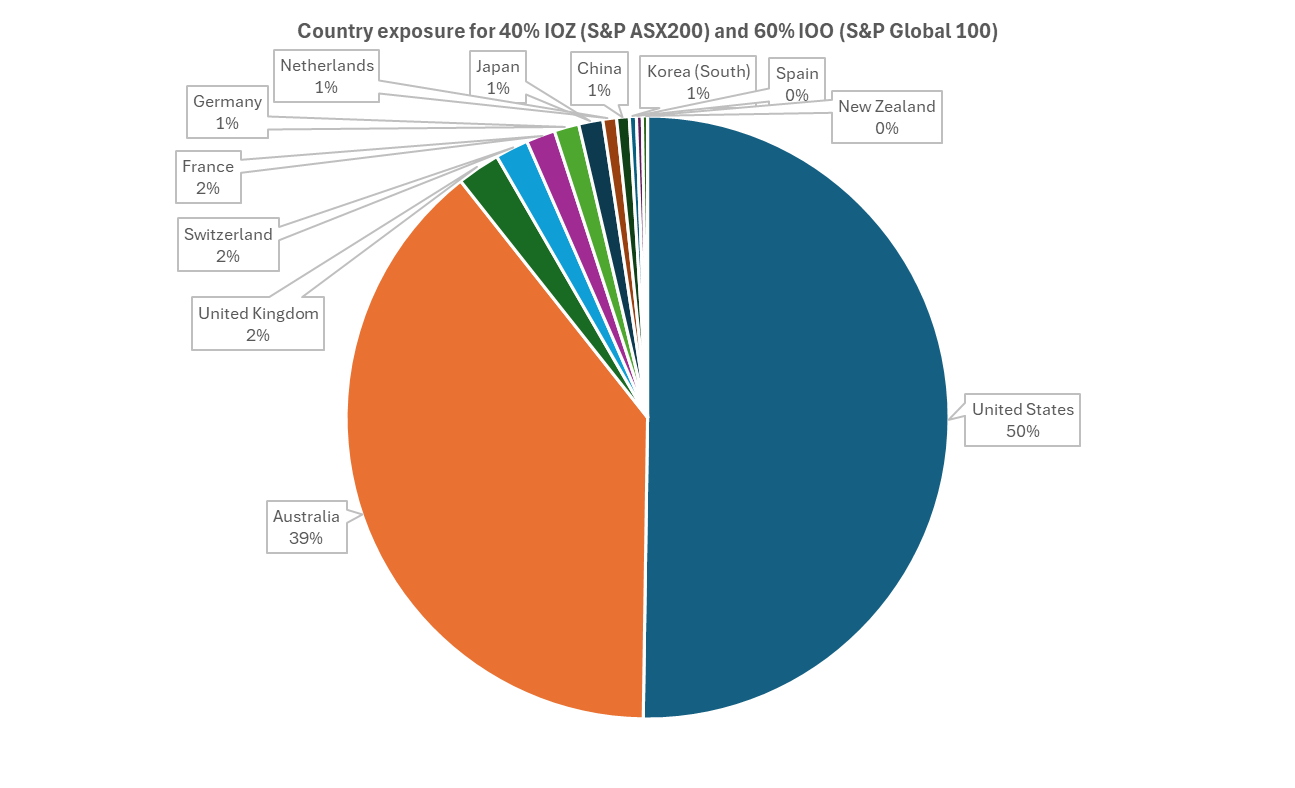

In this shorter note, we are going to unbox a 40:60 portfolio of the ASX S&P 200, using the iShares XASX: IOZ ETF with the S&P Global 100 XASX: IOO ETF.

There are 300 stocks in total that you can buy with two trades.

Let us look at what they are, and how much of each you own in a 40:60 combination.

This provides a neat segue into efficient stock selection for global management.

If there are ones you like more that their weight, then buy those.

If you scan down the top 100 holdings and pick 20 to 30 you like you could go with all stocks and no ETFs or pick 5 to 10 you like and make up the rest with ETFs.

This is a simple method for managing a global portfolio while ensuring that you are not crowded into a single country or sector with undue risk.

Using the ETF blend as a reference portfolio you can more easily see where the gaps may be in your equity exposure. Perhaps you want those, perhaps you do not.

However, the KISS principle urges an 80:20 solution that gets you most of the way there with the least effort. Know what the key risks are and manage those.

The look-through analysis I use below can help you on that mission.

Look-through analysis of ETF holdings

Given the holdings for the iShares Core S&P/ASX 200 ETF XASX: IOZ ETF and that for the iShares Global 100 ETF XASX: IOO, we can work out blend holdings.

You can find the IOZ holdings here, and the IOO holdings here.

(For the IOO holdings you need to navigate to the Underlying Holdings tab).

Here is a spreadsheet with that analysis that I prepared earlier.

This is for a common value date of 18-Dec-2024 (they are a few days late).

I will give you the big picture, not the gory detail.

Firstly, let us look at the top 30 holdings for a 40% IOZ and 60% IOO portfolio.

Notice that with this 40% IOZ and 60% IOO the top holdings are Apple XNAS: AAPL, Microsoft XNAS: MSFT, and Nvidia XNAS: NVDA. The light blue bars are Australian listed holdings, the largest being Commonwealth Bank XASX: CBA.

Those who know their markets may be a bit surprised to see that US automaker Tesla XNAS: TSLA does not appear in the list. Nor does Meta XNAS: META.

This is the reason why it is always a good idea to unbox the holdings in any ETF.

In this case, the IOO ETF replicates holdings for the S&P Global 100 index. This means that any stock which is missing is not in that index. Furthermore, the index rules will determine when and how the index structure and holdings can change.

However, you can see that the basic portfolio structure is sound. The key areas where I would consider changing it are to own less in the top ten holdings.

One simple way to do this is allocate some capital towards direct equity holdings.

There is a lot of Apple, Microsoft and Nvidia, plus Commonwealth bank.

If you put 50% of capital into the ETF combination and 50% into ten individual stocks that were held at 5% each, you can reorient the weights to suit your taste.

For instance, this portfolio is heavy on US holdings.

Our prognosis for US equities remains constructive, but valuations are high, especially in the technology sector. This is important given the blended sector weightings.

Remember that when you mix ETF holdings with individual stocks, you can adjust the country and sector exposure via the ETF-blend weights, and the stock weights.

One of my favored semiconductor names is Taiwan Semiconductor XNYS: TSM which is from Taiwan but can be bought on the NYSE as an American Depositary Receipt.

I also like some of the China technology names listed in Hong Kong.

Stocks like EV automakers BYD XHKG: 1211 and Xiaomi XHKG: 1810 are not there. The large China gaming and fintech play Tencent XHKG: 700 is in the portfolio, but value China technology like Baidu XHKG: 9888 and Alibaba XHKG: 9988 are not.

Longer term, I have held European luxury groups like LVMH XPAR: LVMH and Hermes XPAR: HRMS, but only the first is held in iShares Global 100, and at a low weight.

These are the reasons why core plus satellite investing makes sense.

You can put together an appropriate mix of ETFs to fill out your equity beta, so as to easily manage the 80% component of an 80:20 solution. The remaining 20% can be made up of individual stock holdings. Perhaps 80% of the positions held are stocks and 20% are ETFs, when counting tickers in your brokerage account.

If you had ten positions in total, with two ETFs and eight stocks, you could readily add back the eight stocks that are missing that you most want to own directly.

This could be 2 to 3% position size, if you held 80% in ETFs and 20% in stocks.

You get the idea, dial up or down the allocation to the core and that to the satellite.

Look through analysis tells you how much of the global large cap stocks you would own at any given level of ETF allocation.

In the above table, I have calculated how much of the top 10 stocks in the blended portfolio you would own if you allocated 20% to 100% to the ETF core.

You can see that the sweet spot is somewhere between 40% and 80%. I say this since the largest position is then between about 3% and 6%. In a 25-stock portfolio your average position size is going to be 4%. Having, 60% in the core, you could readily allocate 40% across ten holdings, with an average size of 4%.

I will develop this approach further in future notes.

Conclusion

I use ETF product regularly for my own portfolio construction. The main purpose I use them for is to position the core country, sector, and thematic exposure levels.

You can see from this analysis that many markets are highly concentrated, and so it pays to unbox the ETF holdings and see what you actually own, and how much.

If you think that your chosen combination of ETFs is unbalanced, perhaps because some stock weights are too high (like Apple above), or some are too low, or are completely missing, then focus on this area for your direct stock holdings.

Nobody is perfect, and your individual stock holdings may have higher turnover than your core ETF holdings (I have held some ETFs, and some stocks, for ten years plus).

No matter how you choose to construct your portfolio, all stocks, or all ETFs, or some blend of both, as we advocate, there is a benefit to tracking selected ETFs.

The prices and distributions of ETFs are generally available on market charting sites, and the providers often have more detailed downloads, like actual holdings.

When these are tied to specific benchmarks of interest, such as the S&P ASX 200, you can use the ETF holdings disclosure as a ready source of data to guide research.

None of this is perfect, but it can provide a leg up to the self-directed investor.

Have a look at the attached spreadsheet for an example of such analysis.

We will return to this topic again, as we build out direct stock portfolios. The blended KISS portfolio of 40% IOZ and 60% IOO makes for a convenient reference portfolio.

When doing portfolio management, it is helpful to have a benchmark to beat.

Going forward we will use the KISS portfolio as our benchmark.

You could easily buy it, and the data is freely available.

That is what makes it useful.

Happy holiday season and best wishes for the New Year.

I am back in good health, and eager to trawl these markets for opportunity.

The next post series will be on individual stock ideas for 2025.

Remember the KISS principle.

"Simplify, Simplify, Simplify" - Steve Jobs

It can make your life at lot easier.

What do you know of the possibility of CATL listing on HK market shortly?